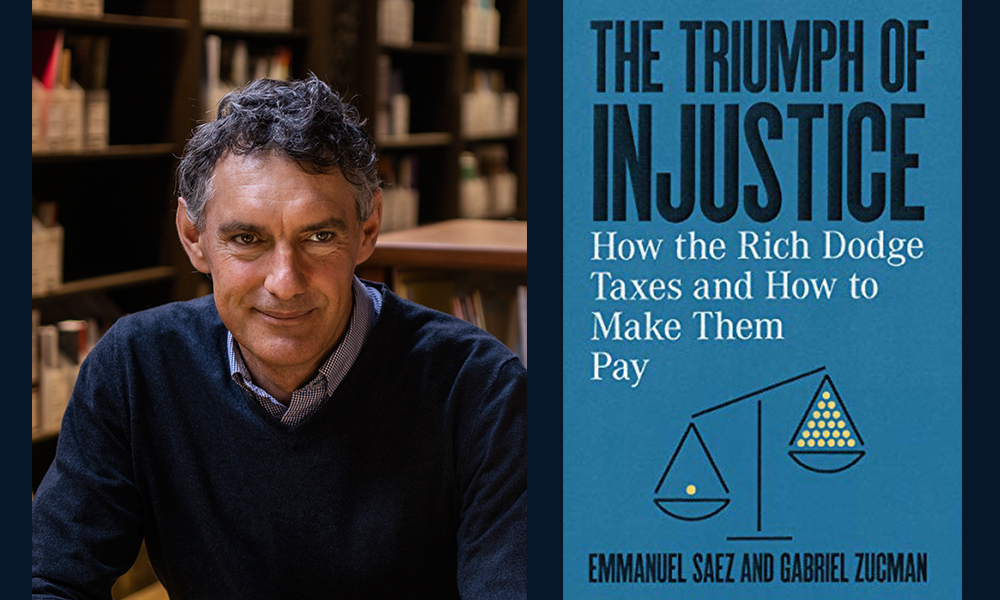

What makes a tax system any democratic society’s most important institution? What makes today’s US tax system much more regressive than it might first seem? When I want to ask such questions, I pose them to Emmanuel Saez. This present conversation focuses on Saez’s book (co-written with Gabriel Zucman) The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay. Saez is an economics professor and directs the Center for Equitable Growth at the University of California Berkeley. His research focuses on inequality and tax policy. He has received numerous academic awards, including the John Bates Clark medal of the American Economic Association, and a MacArthur Fellowship.

¤

ANDY FITCH: Could you describe what makes a tax system perhaps “the most important institution of any democratic society”? And could you offer a quick comparative account of how changes to tax systems over the past 40 years (especially within the US and Europe) seem to have corresponded with diminished public trust in institutions, especially governmental institutions?

EMMANUEL SAEZ: In modern nations, taxes are the way we pool our economic resources for the benefit of society at large. In the US, we pool about 30 percent of our national income through taxes. In European countries, this number is even higher, ranging from 40 to 50 percent. Therefore, how much we ask people to contribute in taxes, and how these contributions get distributed by income group, is indeed a central aspect of the democratic debate. Obviously, trust in government that collects and spends taxes is fundamental for this process to work well.

The US pioneered very progressive taxation in the first part of the 20th century, with very high top rates for the individual income tax and the estate tax, and a very large corporate tax. Since 1980, however, the US has led the way in the other direction, by dismantling its progressive tax system. It is no coincidence that this dismantling happened after the sharp ideological turnaround of the Reagan revolution, which proclaimed that “government is the problem.”

In terms of assembling a comprehensive perspective on US tax progressivity, could you sketch how your expansive research regarding tax percentages paid by various income groups over the past century can help steer us away from aggregate (society-wide) measurements of growth — towards more nuanced analyses of how macroeconomic output, distributional dynamics, and tax policies all impact one another? And particularly at our present moment of high inequality, could you introduce a couple dramatic findings that aggregate measurements often overlook: such as the strikingly low average income not just for poor people but for working-class people today, the striking inequality surge really just among the top 1 percent of earners over the past few decades, the distressing regressivity of our current tax system (with the ultra-wealthy contributing a lower percentage of total income than every other economic group)?

Our research has constructed new comprehensive data series on inequality and the distribution of the tax burden by income group. On inequality, our key innovation is to differentiate the entire national income by individual income groups, so that we can really see how macroeconomic growth (widely discussed in the press) gets distributed among various groups. Our key finding is that while growth was evenly distributed in the post-World War II decades, since 1980 growth has been very unequally distributed. On a pre-tax income basis, while incomes at the top have exploded, real incomes per adult for the bottom half of the distribution have stagnated at an average of $18,500 annually (despite, at the macro level, growth per adult of about 70 percent). The share of total national income going to the top one percent almost doubled from around 10 percent in the late 1970s to about 20 percent in recent years.

On taxes themselves, our key innovation is to track taxes at all levels of government (federal, state, and local), and to differentiate very small groups at the top — all the way to a “billionaire class” (the top 400 richest Americans). Our key finding is that the overall US tax system in 2018 looks like a giant flat tax, with each group paying close to the average 28 percent rate of income in taxes. We find mild progressivity from the bottom to the upper-middle class, but with some regressivity at the very top. In particular, we find that the billionaire class pays only 23 percent of their true economic income in taxes — less than any other income group.

Could you likewise outline broader structural forces coalescing not just in this unfair situation of rich people paying lower tax percentages, but in an escalating “inequality spiral” across our political economy: with workers’ stagnating wages tapped to pay an increasing share of taxes, with wealthy individuals shifting a growing percentage of earnings away from taxable income, with corporate and capital earnings becoming increasingly tax-free, and with wealth capture producing forms of state capture that just add to the spiral? And then, perhaps for one optimistic note, could you outline why, in an era of such excessive concentration, confiscating excessive wealth won’t reduce this overall economic pie much — and will basically just mean a more fair form of sharing?

Right, at the same time that inequality started exploding, the overall tax system became less progressive. So reduced tax progressivity since the 1980s has led to a broader inequality spiral. The key message that the rich got from the Reagan revolution was that “greed is good,” and that they should try to maximize their own income. Indeed, this new tax system allowed them to keep a much larger fraction of income than had been possible for at least half a century. Conservative economists believed that motivating top earners to earn even more would benefit the overall economy, and would trickle down the income distribution.

But instead we saw a trickle up. The rich captured a larger share of the economy, while incomes for the bottom 50 percent essentially stagnated, shut off from economic growth almost entirely. The key lesson we’ve learned is that dismantling tax progressivity leads to a boom at the top — at the expense of those stagnating at the bottom. So reversing these trends in taxation, and reinventing tax progressivity, could, as you say, produce more equitable growth right now without affecting the overall economic pie much.

Now to start breaking down this dense cluster of concerns into more manageable parts, could you first flesh out the basic principle that “people with the same income ought to pay the same amount of tax” — by explaining how any significant disparity between tax rates on income versus tax rates on corporate or capital earnings ultimately makes a progressive tax structure almost impossible?

The billionaire class pays a lower tax rate relative to their true economic incomes for two reasons. First, billionaires pay relatively little individual income tax because they can keep most of their income within corporations (as Jeff Bezos does with Amazon, for example). As long as corporate profits do not get distributed as dividends, and billionaires don’t sell their corporate stock, they don’t have to pay individual income tax. Second, the Trump tax reform drastically cut the corporate tax rate — a tax on profits at their source, and the main tax paid by billionaires. The demise of the corporate tax explains why billionaires now pay a lower rate than other groups. If the corporate tax rate stays as low as it is now (21 percent), it will induce more and more of the rich to incorporate their economic activity, so as to avoid the individual income tax. This, in turn, undermines the progressive structure of that individual income

In terms of present tax systems’ unsustainability, glaring disparities produced by globalization (with revenue-offshoring, profit-sharing, and abstract arms-length-principle schemes, for example, allowing multinational firms to skirt roughly 60 percent of certain US corporate tax payments at present, and 40 percent worldwide) should make it clear to all economic participants which policies and enforcement mechanisms must change. So first, just focusing on potential unitary US government interventions, could you outline a more stringent means of taxing our own multinational corporations as single domestic entities — whether or not they seek to subdivide into far-flung (and potentially sham) subsidiaries?

The key message of our book is that the demise of tax progressivity is not a law of nature, but is in the end a choice that societies make. Even in our modern globalized world, we could re-invent tax progressivity. Taxing multinationals offers a good example. Currently, multinationals can easily shift their reported profits to offshore tax havens, through various tax-accounting gimmicks — thereby drastically lowering their tax bill. And indeed, US multinationals now report almost 60 percent of their foreign profits in these tax havens. But this happens because our poorly designed tax system lets these corporations escape taxes.

So in The Triumph of Injustice, we propose for the US government to collect the missing taxes on these profits reported in offshore tax havens. This would effectively eliminate any incentive to report such profits in tax havens. We consider it crucial that the US already in fact collects all of this information on US multinationals’ reported profits and taxes paid, country by country — so that a revised system would not be difficult to administer.

Similarly, in terms of halting our international race to the bottom in corporate tax rates, could you outline your most basic recommended principles of exemplarity (in the treatment of homegrown multinationals), coordination (in preventing firms from playing countries off each other), defensive measures against recalcitrant tax evaders, and sanctions against foreign tax havens? And if this all sounds too diffuse and administratively complex to some audiences, could you make the moral case that right now we just have certain countries stealing from others — alongside the pragmatic case for why coordinated efforts between just the US and the EU would have such a significant impact as to effectively rewrite the rules worldwide?

We currently live in a world of tax competition. Each country has an incentive to lower its corporate tax rate to attract profits. This tax competition already has led to a sharp decline in corporate tax rates across the world. The US offers just the most recent example with its 2017 tax cut. High-profit multinationals, already the largest winners from globalization (think Apple, Google, Amazon, Facebook), also benefit from very low tax rates thanks to such tax competition.

But we can correct this striking injustice by having each country police its own multinationals in the ways I described earlier for the US. And then, if certain countries still don’t want to police their multinationals, the US could adopt defensive measures to effectively tax those foreign multinationals selling products in the US and escaping taxes by using havens. This would prevent foreign multinationals from possessing an unfair advantage over US multinationals, and therefore would also discourage US multinationals from themselves becoming foreign multinationals through “inversions.”

Naysayers seeing no means to prevent the offshoring of multinational earnings might consider it only reasonable to acknowledge this reality and lower our corporate rates — just as they might with capital tax rates. Could you situate both claims within a broader pattern of how America’s once robust post-New Deal tax system has been undermined in serial fashion, through the rationale that taxing the richest Americans has “just become too hard”?

Reducing taxes on the rich has never been popular. So how do progressive tax systems get undermined? It happens in two steps. First, you let avoidance and evasion fester by weakening tax enforcement. For example, in the early 1980s, partnership tax shelters bloomed. Second, you claim that high top tax rates create incentives to avoid taxes, that it is impossible to tax the rich, that therefore we should lower top rates. Indeed, the top individual income tax rate fell under Reagan from 70 percent in 1980 to 28 percent in 1988. We’ve seen the same evolution with the corporate tax rate, recently slashed from 35 percent to 21 percent by the Trump administration.

Your own book asserts that simply raising rates, without first creating a sustainable tax system, might make matters worse, presumably by incentivizing further evasion among those with the resources to pursue such schemes. You also discuss the need for less codifiable changes, such as a pro-social consensus that collective action can promote (and fairly share) a broader economic prosperity, or trust in government as a central player coordinating complex society-wide investment and targeted distributions. Here with the precedent of, say, mid-20th-century Americans’ acceptance of high tax rates (with comparatively little evasion), could you describe what the right balance of proactive norm-fostering and decisive enforcement could look like today?

Tax progressivity requires societal support, good design, and effective enforcement. Societal support means that the public by and large endorses this policy of taxing the rich more than the rest, and considers tax avoidance and tax evasion immoral actions. But you also need a well-designed system that offers few opportunities for avoidance and evasion in the first place. You need vigorous enforcement to quickly identify and prevent new forms of avoidance/evasion.

Today, Donald Trump can actually boast about not paying taxes (as in his famous response to Hilary Clinton during the 2016 presidential debates: “That makes me smart”). Today the IRS faces starvation-level funding. So both our social norms and our enforcement mechanisms need to change if we ever hope to restore a successful progressive tax policy. And historical evidence shows that such changes can happen quite quickly, as they did during Franklin Roosevelt’s New Deal administration.

Could you likewise fill in a few details on what would make a new progressive wealth tax for the ultra-rich only reasonable: again with much of this wealth never taxed at income rates comparable to what workers pay, and with the richest individuals’ corporate shareholdings not providing declarable income for now? Could you describe what makes it in fact relatively easy to track such wealth accumulation, and for those accumulating the most to pay high tax sums through corporate shares if necessary — particularly if we adopt your innovative approach to resolving disputes about the market value of such shares on the marketplace itself?

Recently, discussions of a wealth tax have erupted in the US, with several presidential candidates on the Democratic side proposing wealth taxes. Such a wealth tax could get levied annually on families with a total net worth (the sum of all owned assets minus debts) above a high threshold (32 million dollars, for example, in Bernie Sanders’ proposed wealth tax). Such a tax could have its own progressive rates (again, in the Sanders proposal, starting at one percent, and climbing all the way to eight percent for wealth above 10 billion dollars).

Such a wealth tax can reduce excessive concentration more powerfully than the income tax, because it goes directly after the stock of wealth — rather than the flow of income generated by that wealth. And this effective instrument for curbing wealth concentration at the very top is also politically powerful. It polls well both among Democrats and Republicans. It offers a very clear and simple tax on the very rich.

In The Triumph of Injustice we argue that wealth taxes, like other taxes, succeed or fail based on how well they get designed and implemented. Most European wealth taxes did not work well. They were easy to avoid, or evade. They excluded large fractions of wealth. We think this new wealth tax proposed in the US avoids those flaws. You can’t escape it by leaving the country, because it’s based on citizenship not residence. You can’t easily hide your wealth in offshore bank accounts, because of strong regulations requiring foreign banks to report to the US.

To close then, could you describe the distinct social contribution that you see taxjusticenow.org providing, in terms of making a “new economic approach” (an approach seeking to track all means of income and tax distribution / redistribution, at a wide range of economic levels, always interacting dynamically with broader macroeconomic and socio-political forces) palpably available to ordinary citizens — as they too attempt to think as precisely, rigorously, and transparently as possible about perhaps our most important public institution?

Our book aims at making the tax debate accessible to a broader public. After all, if taxes are the most important democratic institution, the people need to understand the key elements of this debate. That’s also why we constructed the taxjusticenow.org website, where you can visualize quite simply the progressivity (or lack thereof) of the current tax system, and explore how changing that system (by, for instance, adding a wealth tax, or adjusting income tax rates, etcetera) would affect overall tax progressivity. We also model the presidential candidates’ tax plans, so that users can see what these plans would provide in terms of revenue and progressivity — but also can play with the various plans and further improve them. Taxes of the people, by the people, for the people!

Photo of Emmanuel Saez by Cayce Clifford.