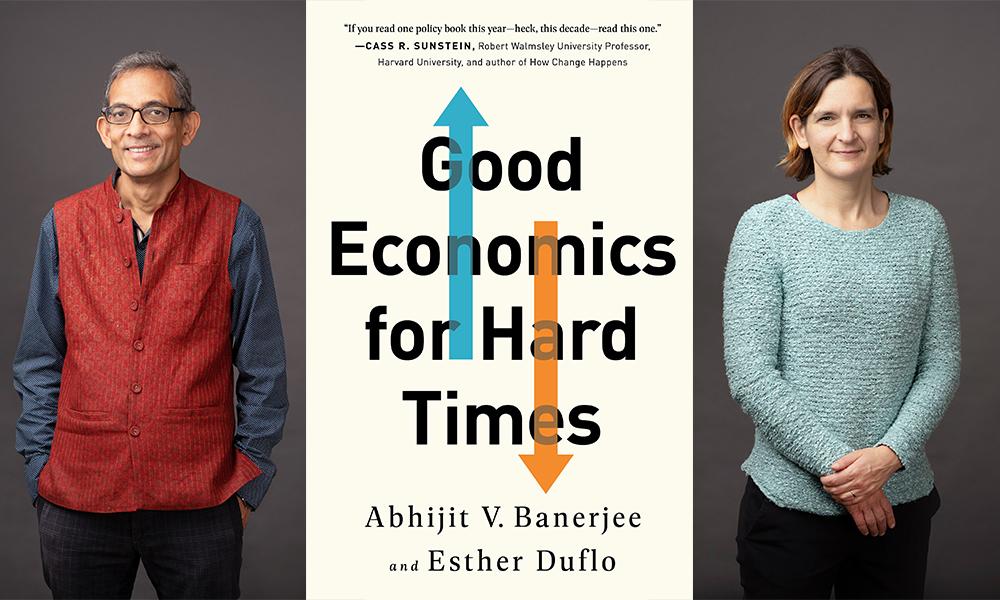

What makes market mechanisms much “stickier” than classic economic models might suggest? What most often gets in the way when streamlined plans for self-sustaining development don’t lead to effective policy implementation? When I want to ask such questions, I pose them to Abhijit Banerjee and Esther Duflo. This present conversation focuses on Banerjee and Duflo’s book Good Economics for Hard Times. Banerjee and Duflo are winners of the 2019 Nobel Prize in Economics, professors of economics at the Massachusetts Institute of Technology, and co-founders and co-directors of the Abdul Latif Jameel Poverty Action Lab (J-PAL). Banerjee has been named one of Foreign Policy’s top 100 global thinkers. He was appointed to the UN Secretary-General’s High-level Panel of Eminent Persons on the Post-2015 Development Agenda. Duflo is a member of the American Academy of Arts and Sciences, and a recipient of academic honors that include: the Princess of Asturias Award for Social Sciences (2015), the Infosys Prize (2014), the Dan David Prize (2013), a John Bates Clark Medal (2010), and a MacArthur Fellowship (2009). She is a member of the President’s Global Development Council, a founding editor of the American Economic Journal: Applied Economics, and current editor of the American Economic Review.

¤

ANDY FITCH: Your book presents economics as a discipline constructively inclined towards consensus-building right now, as driven by empirical research (often in the form of randomized controlled trials, or RCTs), rather than by a preceding era’s theoretical conjectures. For one clear example of how reductive conceptual models might fail to explain patterns that ordinary workers see play out in their own lives, could you sketch what makes labor markets, both in poor and in rich countries, much more sticky than exuberant appeals to “creative destruction” might suggest? Why can’t workers just “adapt” to ever-shifting economic trends in the ways that previous generations of economists might have coaxed them to?

ABHIJIT BANERJEE AND ESTHER DUFLO: Despite a widely shared sense in the popular mind that hordes are waiting right across the border to rush in (just yesterday, a minister in India’s national government, G. Kishan Reddy, declared that: “Half of Bangladesh will be empty if India offers citizenship to them”), economists have long wrestled with the fact that people don’t seem to move enough. To take a recent example, between 2010 and 2015, at the height of their country’s massive economic crisis, fewer than 350 thousand Greeks (representing at most three percent of Greece’s population) appear to have moved elsewhere in Europe, despite Greece’s unemployment rate of 27 percent in 2013 and 2014, and with Greeks (as EU members) free to work anywhere in Europe.

Or take the example of Rangpur in Bangladesh, where, during the yearly monga season, people literally starve. Bangladesh is a small country, and does not prohibit internal migration. Certain jobs in the city will likely pay much more than anything that workers can get in Rangpur during these bad months. So to test whether it was simply ignorance holding back potential migrants, an NGO gave some of them, chosen at random, information about the benefits of migration (basically what wages they could expect in the cities). This had absolutely no impact on migration rates. But then perhaps the migrants did not believe that they could actually get those jobs — so, to convince them, the NGO offered some of them, again chosen at random, an extra inducement: $11.50 in cash (roughly the cost of travel to the city) and a couple of days of food, but only if they migrated.

That offer did get 22 percent more migrants to the city, and almost all of them did find jobs, and earned substantially more than they would have otherwise. Their families consumed on average 50 percent more calories, taking these families from near starvation to a comfortable level of consumption. And yet, even the very next year, only about half of these additional migrants went back during the hungry season, despite knowing from personal experience that jobs were available and attainable. In other words, even semi-starvation often doesn’t offer enough inducement to migrate.

Many Americans these days seem similarly resigned to going down with the ship. In the 1950s, seven percent of the US population used to move to another county in a given year. Now less than four percent move in this way. According to the Census Bureau, internal migration in 2018 hit a record low. That’s one reason why increased competition in many industries, often from lower-cost Chinese producers, has had such debilitating consequences, despite generally low unemployment. Most workers who lost their jobs as a result have not relocated to where the new jobs are, but instead have stayed on as their local economy went into a tailspin, and often have ended up dropping out of the labor force.

What holds them back? Many things of course, most very familiar to all of us. They would miss their friends and extended family, and all the comforts embeddedness can bring (people to lean on in an emergency, people who know you by more than your house or your car). Of course these workers also could expect to gain something in return for moving: a job, but what kind of job? Since employers tend to reserve jobs with serious responsibilities for those they know and trust, probably not these jobs — at least not to start with, unless you have some very specific skills or know someone useful. From the point of view, say, of workers 35 or 40 years old, who already have climbed that ladder and gained some recognition, this means starting over at the back of the line. Plus these transplanted workers would face all the uncertainties of what shape life will take: where would they live, with what kinds of neighbors, with childcare coming from where? And in the developing world, the poor quality of urban infrastructure often exacerbates these tradeoffs, making it hard to find a place to stay, apart from the smelly slums or the dangerous sidewalks. No wonder people try to stay put.

Sticky lending practices, especially in less industrialized countries, likewise point to the need for economists not just to formulate abstract principles and outline bullet-point agendas — but to rigorously track the real-world implementation of targeted policy levers, designed to improve particular localized circumstances. Could you describe, for instance, what on-the-ground research might find about why capital allocation does not play out as seamlessly as conventional models might anticipate, and how a more precisely calibrated intervention might seek to address such snags?

Economists tell a very simple story about capital markets: that banks should charge a uniform interest rate to all their clients, who can borrow as much as they want at that rate. Economists tell a similar story about the stock market, assuming a level playing field, with the size of your business depending on your ambitions and talents — not on how much money your daddy left you. And supposedly the more productive but less wealthy participants can just borrow more, and since you only borrow money that can be profitably invested, needing to borrow doesn’t pose any problems.

But the problem comes from the world not actually working this way. Businesses operating within a few hundred feet of each other might get charged drastically different interest rates. Fruit-sellers in India may pay up to five percent per day (54 million percent per year) to the wholesaler who sells them fruit, while the large department store these fruit-sellers work outside may only pay a 12 percent annual rate. These differences are less stark in the United States, but a small business still might sometimes borrow from a loan-shark at three percent per week, while a large and established business may get a bank loan close to three percent per year. Moreover, very few people anywhere in the world can borrow as much as they want: most face a fixed cap that the bank (or other lender) calculates, based on the borrower’s net worth.

The combination of these two facts means that success for the businesses one sets up depends very much on what one starts with. The wealthy get to borrow more, and pay much lower rates, and therefore invest in more lucrative projects. The poor, irrespective of their talent, enterprise, and effort, are constrained to much smaller efforts. Wealth breeds wealth.

Because of such stark unfairness and inefficiency, many countries have policies to try to help new and small entrepreneurs grow their businesses, by improving their access to capital. The traditional banking system almost everywhere in the world seems to have problems dealing with those entrepreneurs not backed by blue-chip credentials, or not possessing significant assets to put up as security. The internal management of banks, which places a lot of weight on simple and clear rules and an elaborate paper trail for lending decisions, seems to contribute to this problem. As a result, proactive national policies often combine ways of forcing banks to become more adventurous in lending, and of fostering special institutions focused on lending to small firms.

The US, for example, has the Small Business Administration and the Community Reinvestment Act. In India, banks must lend a certain fraction of their portfolio to the “priority sector,” which includes small businesses and agriculture. Microcredit, another category of such interventions, comes from the theory that lots of potential entrepreneurs would start successful businesses if only they could get a loan at a reasonable price. However, accumulated evidence from RCTs across the world suggests that this may be overly optimistic. The businesses that get established through this relatively cheap credit source often end up unprofitable and unsustainable — although better access to credit does strengthen a lot of businesses that already had existed. More generally, the main message from the large and growing empirical literature is that small firms in developing countries face a wide range of prospects, stretching from barely sustainable to incredibly productive uses of what little capital they have (as well as of their entrepreneurial talents). But economists still have not fully resolved a scalable intervention that puts money in the hand of the productive entrepreneurs, and avoids the rest. This is one of the most exciting research areas in development economics.

Faulty economic paradigms (such as those nostalgic presumptions of a dynamic American society fueled by both geographical and class mobility) can lead to problematic political consequences when individuals, or whole communities, feel compelled to blame somebody for blocking their access to such prosperity. So how might contemporary research correct misperceptions, for instance, about the impact of low-wage immigrant workers on a community’s native-born workers? And how might pro-immigration advocates likewise misperceive the motives of immigrants — or overstate prospects for US immigration to relieve the economic hardships of so many people all around the world?

Two basic misperceptions exist regarding international migration. The first one we already mentioned: the fear of an invasion by people desperate for better opportunities, and the corresponding claim that we need to build new walls to keep them out. In fact, most people do not even move when they face no legal or physical barriers, which again partly explains why we see such concentrated pockets of deep poverty in the US or the North of England (or rural Indonesia, for that matter). Many people won’t even move to other places within the same country, let alone internationally.

The second misperception comes from this idea that low-skilled migrants take the jobs of low-skilled natives. Natives often end up blaming their economic misery on immigrants. And yet a National Academy of Science panel has summarized the vast literature on this subject quite bluntly: “Empirical research in recent decades suggests that findings remain by and large consistent with those in The New Americans National Research Council (1997) in that, when measured over a period of more than 10 years, the impact of immigration on the wages of natives overall is very small.”

Economists have reviewed many examples of large migration waves (or, conversely, episodes when migrants get sent back home). Every time, research suggests that native wages see no or very small impact: partly because demand expands with the arrival of these new migrants, partly because migrants settle in places where nobody else wants to go, or take jobs nobody else wants to do, or both — and partly because when employers cannot find new migrants to hire, they often respond by replacing human labor with machines, not by hiring low-skilled native workers.

Again in terms of reductive inherited paradigms, economists’ foundational emphasis upon free trade promoting broad-based growth can stand out as dubious to contemporary observers who see international trade’s disparate (sometimes acutely damaging) impact across various industries and regions in the US — or who see drastically increased disparities in the liberalized economies of South Korea, China, Vietnam, and India. Of course each of these nations would need its own proper account. But what most elastic formulation might you offer that, since societies as a whole benefit from trade liberalization, they should, as a proactive measure, make sure to redistribute some wealth away from those who gain most through trade, towards those most harmed by trade?

Core economic theory stipulates that, while trade should on average benefit the countries that participate, it also has distributional effects (although economists tend to underestimate these effects, because again they assume people will change jobs and adjust). So economic theory often does call for some efforts to compensate the losers.

But core economic theory also says that trade will benefit workers and poorer people, especially in poorer countries. In principle, trade itself should have reduced inequality in places like South Korea, Vietnam, and India. This may be one reason why you still don’t see an adequate effort to compensate the poor in these countries. In practice, inequality also rose in these (until recently, at least) poor countries, with not much done to redistribute the gains that trade did provide.

By extension, both in poor and wealthy countries, regional industrial clusters and just-in-time production models seem to work quite well — at least during upbeat economic cycles. So what to do during sustained downturns, when such interdependent networks concentrate the loss for displaced workers in displaced firms in displaced industries in displaced parts of the country? What kinds of multipronged public interventions might help most “when the cluster unravels,” and how to offer substantial support to those most in need without generating a backlash among firms, industries, communities who fear or resent potential rivals seeming to get such special treatment?

If clustering generally benefits the economy, then we should be willing to pay to offset its downside, which can involve the wholesale unraveling of an entire area when something bad hits the dominant industry. First the jobs in this industry fade away, but then since consumer demand drops, the restaurants, the movie theaters, the shops and shopping malls all slowly decay or disappear. Given that what happens to an industry usually stems from broader societal developments beyond the control of any one community (usually competition from abroad, or from new technologies), why should they bear the entire burden? The Trade Adjustment Assistance (TAA) program operates from this premise. Under the TAA, qualifying workers can extend unemployment insurance for up to three years, as long as they receive training to work in other sectors. The TAA also will pay for training (up to 10 thousand dollars a year), in order to give workers some time and support so they can land on their feet. However, as a federal program, the TAA remains minuscule. In recent years, regions most affected by trade have received a paltry 23 cents per head in TAA money, compared with 549 dollars in lost income.

And yet, the TAA quite effectively serves the rare worker who actually gets it. Access depends on your luck with getting assigned (essentially at random) to a sympathetic Department of Labor caseworker, who makes the eventual judgment on whether you should receive this assistance. Using a database of 300 thousand petitions, Ben Hyman compared applicants assigned to more or less lenient caseworkers (more or less likely to approve TAA support and retraining). Over the next decade, applicants assigned to more lenient caseworkers earned 50 thousand dollars more than those assigned to less lenient caseworkers.

What keeps an effective program like the TAA so underfunded and underused? Ignorance about the program (which, strangely, didn’t receive much attention until Hyman’s work) plays its part. More broadly, American society still has a very limited understanding of just how skewed the pains from trade have become, relative to the gains. The gains tend to diffuse (particularly among many consumers benefitting a small amount from paying lower prices), while the losses often hit with concentrated cataclysmic force — taking away workers’ and communities’ entire way of life. Finally, trade economists, while paying lip service to this idea that trade can provide a win-win if society adequately compensates the losers, seem to have paid very little attention to whether any realistic modes of compensation actually become available. Correspondingly, politicians never put this concern on top of their agenda.

Similarly, while we can’t pinpoint the precise impact of various overlapping factors, increased economic and political disparities certainly have come about in conjunction with Reagan-era (and subsequent iterations’) tax cuts for the wealthy. So in terms of taxation (where the US differs most from European counterparts), could you sketch how raising tax rates for the super-rich would bring economy-wide benefits: not only in revenue, but also in labor-market restructuring? And could you then clarify why even this targeted approach to sharing the super-rich’s wealth will not come close to a sufficient redistribution across our society — and might instead prove most pivotal for legitimating calls for the (non-super) rich, for the modestly above-average, for even average workers, to contribute more?

The inequality explosion over the last 40 years came about to a substantial extent from the combined direct and indirect effects of the Reagan-Thatcher tax cuts. These tax cuts gave the rich more money to put away, to accumulate wealth faster, to invest more and earn even more from these investments. But perhaps a more important part of this story comes from what happened to compensation packages for top management. In the 1950s, 60s, and even 70s, with tax rates on high incomes often 70 percent or more, most companies considered it a bit self-defeating to pay exorbitant salaries to top managers, with most of this income ultimately going to the government.

But today, even if the US raised income taxes on the rich to match Denmark’s rates, the overall tax revenue as a share of US GDP will still be much lower than the shares collected in 2017 in Denmark (46 percent), France (46 percent), Belgium (45 percent), Sweden (44 percent), and Finland (43 percent). One basic reason comes from this fact that if US tax rates returned to mid-20th-century levels, presumably top incomes would again drop significantly. Companies would move away from paying astronomical salaries — which may be a desirable change in itself, but which will defeat the purpose of raising revenue. In other words, current proposals to raise top income tax rates above 70 percent might help to reduce inequality, but won’t bring much new money to the state.

And to really make a dent in our drastically unequal opportunities today, it will be critical for the US government to raise more money and to spend it wisely. In the European countries with high top rates, and even in those that still have a wealth tax, the majority of government revenues come from taxes on average earners. In other words, the dream of a tax reform that leaves “99 percent of the tax payers with a lower tax bill” would guarantee that the US remains unable to redistribute adequately to those falling behind. Tax reform needs to apply not solely to the ultra-rich, but also the merely rich, and even the middle class.

Of course this isn’t a particularly popular approach, and will not happen overnight. Political leaders will need to apply a “show don’t tell” strategy, where they start by raising rates on the super-rich (for which the public has reached some consensus) via high marginal income taxes or a wealth tax, and then spend these revenues on visible and effective programs which can increase trust in government. But then political leaders will need to begin raising more revenues from many more of us.

Specifically in terms of today’s market concentration, could you describe how such concentration again might complicate economic models, here those premised upon positive-sum human-capital gains? How have certain recent tech developments in fact contributed to diminished economic dynamism — with less competition, with innovators-turned-monopolists often thwarting further innovation, focusing instead on stifling potential rivals?

Thomas Philippon’s excellent new book The Great Reversal focuses on this exact issue, and deserves a read. Philippon shows that concentration has increased in the US, and links this concentration to reduced innovation. When a monopolistic firm feels no competition breathing down its neck, it has less incentive to invent something new. If it innovates at all, this typically involves cutting labor costs — directly imposing new burdens both on displaced workers and on the society that must support them.

Here could you sketch your critique of yet another inherited paradigm: overemphasis on national GDP gains, often at the expense of broadly distributed quality-of-life gains? What tangible shifts in policy direction would you anticipate coming from re-conceiving GDP growth as but one means towards the broader goal of improved quality of life for average people, and for poorest people most of all?

Focusing on GDP leads to two central concerns. First, we don’t really know how to affect GDP growth (beyond avoiding really basic economic mistakes, such as hyperinflation or complete nationalization). Usually when countries have tried too hard to stimulate GDP growth, they have just created other problems for themselves. The US and the UK went for tax cuts and deregulation, fueling huge increases in inequality, without really boosting growth relative to most European countries. Japan went on a spending spree when its GDP dropped, which likewise failed to restart growth, but which has produced a huge debt burden.

Second, GDP growth does not guarantee improved social welfare. GDP offers a means to an end — and not the only one. Such growth helps society no doubt, when it creates jobs or raises wages or plumps the government budget and allows for more redistribution. But the ultimate goal should still be to raise the quality of life for the average person and especially for the worst-off person. Quality of life means more than just consumption. Most human beings care about feeling worthy and respected. Most of us suffer when we feel that we are failing ourselves and our families.

So while increased consumption certainly could improve many lives, even very poor people also care about the health of their parents, about educating their children, about having their voices heard, about being able to pursue their dreams. Here again, a higher GDP can offer one way to assist the poor, but by no means the inevitable best way to do so. In fact, quality of life varies enormously among today’s middle-income countries. Sri Lanka, for example, has close to the same GDP per capita as Guatemala, but maternal, infant, and child mortality are much lower in Sri Lanka (and are comparable with the US). And unlike for GDP, we actually know how to affect these types of outcomes, and also how to keep improving on them. In particular, RCTs have taught us much about how to better coordinate and distribute resources to improve human welfare. Here much progress has been made in the past few decades in poor countries, even in some countries with slow GDP growth.

Sure your book describes, in developing economies especially, projections of optimized productivity often failing to play out — with many poor countries allocating resources quite inefficiently. But could you also describe some recent historical instances of countries successfully addressing these most frequent failings in credit markets, land markets, labor markets, market competition? Could you outline your broader case that some of the most celebrated high-growth economic models in recent decades might in fact derive from countries finally tapping this long pent-up productive potential? And, by extension, could you sketch your cautionary argument that such countries should resist complacent assumptions of current growth rates now continuing into perpetuity?

India and China provide the two most important growth stories of the past three decades. Both economies started from dramatically misallocated resources, and have since developed something more reasonable. In China, before Deng’s reforms, people could not even grow tea in the suitable regions, because the state forced them to grow grains. In India, a large share of the economy was reserved for “cottage industry,” with entry severely limited in other sectors. The largely nationalized banking sector, for example, was extremely inefficient.

Again, when all of this changed, that opened great margins to increase GDP. Today, resources in India still get less efficiently allocated than resources in the US, but some of the low-hanging fruits have been harvested. That transition allowed for extremely fast growth rates, but one cannot expect those rates to persist long after these gross misallocations have been corrected. So as we worked on this book, in 2018, we predicted a possible decline in India’s growth rate (this was already well under way in China). Unfortunately, we got that right, and Indian GDP growth has dramatically slowed since then.

Economic models prioritizing improved lived outcomes, rather than ever-accelerating industrial growth, take on added urgency in a climate-change context — for instance if we stop assessing nations’ greenhouse-gas contributions in terms of what their industries produce, and instead focus on what their citizens consume. How might this type of “no free lunch” approach push economists beyond their own professional comfort zone, particularly in terms of trying to change (rather than abstractly posit and universalize) people’s preferences? How might, say, a revenue-neutral carbon tax (supplemented by cap-and-trade policies) exemplify this mode of prescriptive policy nudge designed to counteract personal biases towards unreflective inertia?

Climate change risks undoing the considerable recent progress made against poverty worldwide. Climate change is also incredibly unfair. The contribution to CO2-equivalent emissions strongly skews towards rich countries (especially when we attribute the emissions to what a country consumes, rather than to what it produces). The 50-10 rule summarizes these stark facts well. Ten percent of the world’s population contribute roughly 50 percent of CO2 emissions, while 50 percent of the world’s population contribute just over 10 percent. Those 10 percent highest contributors come from rich countries. In contrast, the damage occurs essentially in poor countries, for two reasons: poor countries tend to start off hotter, and they have fewer resources to adapt. Between 1957 and 2000, India for example experienced on average five days per year with an average daily temperature above 35°C. Without significant changes in global climate policy, India now faces projections, by the end of the century, for 75 such days each year. The typical US resident will experience 26. And in the US, an additional day of extreme heat (exceeding 32ºC) raises the age-adjusted mortality rate by about 0.11 percent. In India, the effect is 25 times larger.

Accordingly, development economists cannot stop thinking about climate change. Many economists feel fairly optimistic about our ability to counteract climate change if we act now. The cost of clean energy has already gone down, and could drop even further with more incentives to invest in green technologies, and with a sufficiently large market providing efficiencies of scale. Because economists tend to think that the right price can provide the right answer to any problem, the profession also tends to support a carbon tax as the main climate solution.

We are a bit more circumspect on both ideas. While clean technologies might drive out dirty technologies, they also might not. After all, the dirty technologies will still exist. If fewer people use coal and oil, then prices for these fuel sources could plummet. This would make it very tempting to return to them. The price for these non-renewable resources still might rise over time, as supplies run down, but our modern economies probably could find enough coal and oil under the ground to take us to Armageddon.

So in our opinion, societies should prepare for this possibility that no free lunch arrives. You might not get to transition smoothly to driving your solar-powered Tesla to work. You might need to take the train. And coaxing our societies to consume much less might indeed require changes in how people live their lives, and perhaps correspondingly in what they value. Fortunately, we believe that values and preferences are in fact much more malleable than economists often assume. Progress in behavioral economics has shown that people’s “preferences,” particularly on topics they know little about, are largely arbitrary, and very easy to influence. Similarly, as creatures of habit, we might feel much more inclined to consume less energy if we see our neighbors consuming less — and these kinds of changes can become systemic and sustainable. Europeans, who consume much less energy than Americans, do not seem any sadder for it.

A carbon tax may help to get those changes going. But we need to approach the political economy of such taxes carefully. Increases in transportation prices have sparked huge social movements recently in France, Chile, and Iran. Any related carbon tax will need to include an explicitly linked redistribution effort. Carbon tax proceeds could get redistributed to the poor in a lump-sum way, or you could even link these revenues to a broader redistribution effort — announced in advance, and linked to, say, infrastructure improvements. Governments will still skate on very thin ice, however. Those selected to bear increased carbon prices remain deeply suspicious that they should be singled out this way, and forced to pick up the costs of preventing climate change.

Returning then to economic nudging (whether or not with any moralistic judging), what modified forms of conditional cash transfers do you see most effectively fulfilling people’s needs today, and most successfully building support among the poor themselves for such redistributive programs? And what could a 21st-century “smart Keynesian” approach look like: prioritizing less a UBI than a universal right to be a valued contributing member of society, focusing on undervalued fields like childcare and early-childhood education and eldercare, communicating to aid recipients not the message that “You are being bailed out” so much as that “I am sorry you’re the one this dislocating change happened to, but we rely on you, and by acquiring new skills and/or moving to the right place, you can play a crucial role in our economy”?

Social-protection systems in rich countries (and to a large extent in poor countries) still operate under the Victorian era’s long shadow. We still seem extremely concerned that poor people might take advantage of our generosity and become lazy. We even tell ourselves that poor people will benefit more by receiving slightly harsh (rather than excessively generous) treatment. We subject them to complex paperwork, humiliating interviews, various (sometimes mutually incompatible) requirements. We’ve built our own modern version of the English poor house. However, no evidence exists that a more generous system would actually make people work less. In fact, as we discussed earlier, most aid recipients value the respect (and sense of self-respect) that comes from being a productive member of society — whereas a humiliating welfare system hurts everybody: both the individuals who need it today, and the individuals who live in fear of someday becoming one of “those people.”

So our societies do need to profoundly rethink their social-protection systems, and to put dignity at the center. Some people have suggested establishing a universal basic income to address these concerns. But we remain skeptical that this would work well for rich countries. First of all, it doesn’t discriminate between people’s circumstances, though of course a 50 year-old displaced from her South Carolina furniture-making job needs more help than a 25 year-old New York City transplant. And we believe in concentrating assistance for those who need it most. That allows society to make this assistance much more generous. So we don’t have a recommendation as slick as the UBI, but we recommend a number of approaches: including a dramatic expansion of the Trade Adjustment Assistance program (perhaps repackaged as a “GI bill for the veterans of economic disruption”), and a “smart Keynesianism” in the form of public investment in employment sectors both useful to society and providing good jobs — with child care as the prime example.

Portraits of Abhijit Banerjee and Esther Duflo by Bryce Vickmark.