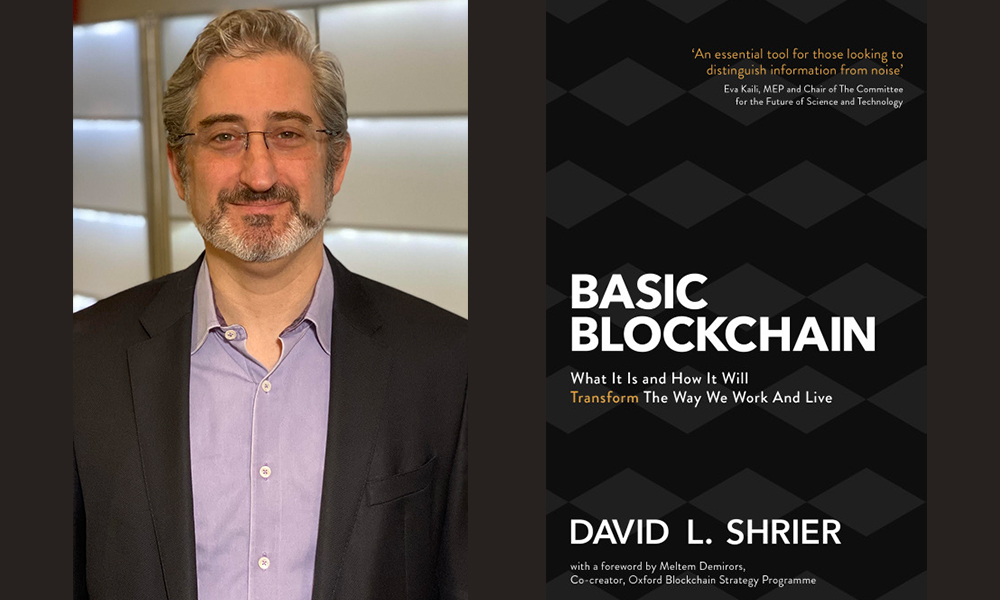

How might blockchain technology help to make health data more accessible, more secure, and more independent from corporate profit-seeking? How might it help us to track the sourcing and the emissions footprint of our food and energy? When I want to ask such questions, I pose them to David Shrier. This present conversation focuses on Shrier’s book Basic Blockchain: What It Is and How It Will Transform the Way We Work and Live. Shrier, a globally recognized authority on tech-driven innovation, advises entrepreneurs, corporate leaders, and governments. He has a dual appointment at the Massachusetts Institute of Technology and at Saïd Business School (University of Oxford), teaching on subjects including financial technology, AI, and data science. For Oxford, Shrier leads online programs such as Oxford Blockchain Strategy, Oxford Fintech, and Oxford Cyber Futures. He is currently involved with four AI-enabled startups derived from MIT research (including online class provider Esme Learning, and collaboration software company Riff Analytics), and has published multiple books on blockchain, financial technology, and cybersecurity.

¤

ANDY FITCH: Could we start with a couple characteristic situations in which multiple parties, perhaps possessing little reason to trust each other, might find it beneficial to interact through a blockchain? And could you sketch how a blockchain’s distributed ledger, with numerous identical copies constantly communicating with each other and updating themselves, operates to build that trust?

DAVID SHRIER: First, when I talk about blockchain, I basically mean a database. Blockchain has special features, which make it an interesting kind of database. But people shouldn’t think of blockchain as somehow weird or mysterious or scary. This particular type of database has certain features which make it particularly good for solving certain kinds of problems. So Basic Blockchain focuses more on the question of “Why blockchain?” rather than “What is blockchain?”

So why do you want this special database? Why not use an Oracle database, or some other kind of database, or even just a paper ledger book? Why do you need the blockchain? Well, for one type of circumstance, you might have a lot of people who don’t know each other and can’t trust each other, or who do know each other and still don’t trust each other (who maybe compete against each other). But they still have to share information. So these multiple stakeholders might collectively say: “Well, why don’t we give the information to someone we all trust, and have them look at it?” But then what happens if no such person exists? That’s when blockchain technology comes in: when you have multiple stakeholders, with everybody trying to reconcile all of the available information.

For one concrete example, blockchain actually got started with the 2008 financial crisis, with many people distrusting banks and distrusting government. All these financial companies had lost all their customers’ or shareholders’ money. Why would you give anything else to the firm that just lost all your money? And mistrust in government also had reached new highs. So that led to this question of “Who can you trust?” Well, it turns out that at least one group of people trusted technology most of all. They put their faith in this special kind of database which relied on multiple copies. Everyone involved had a copy. Everyone could see anything happening in the database. Everyone could use the database to keep track of money. You get this radical idea where a bank doesn’t have the sole database and provide the single source of truth, and collect everybody’s money — which then gets hidden in the bank’s records (or maybe you can look at part of your own record, but you certainly can’t see anyone else’s).

That basic and really provocative idea just took off. Recently Bitcoin and other digital currencies (or cryptocurrencies) held a nominal value of about 300 billion US dollars. This might sound small in comparison to the M1 money supply of a G7 country, but remember that these cryptocurrencies started from scratch not very long ago, and not run by any government. Already you see lots of stakeholders putting their money into these databases and transferring value and moving it around. Moving money with Bitcoin, or other cryptocurrencies like XRP (which Ripple makes) or Ethereum or SendFriend, costs much less than moving money through Western Union or other traditional money transfer companies. These new transfer companies charge one-tenth as much, so now people in poor countries can move money without paying massive fees.

Certain basic characteristics of these transfers make blockchain an especially effective way of handling the money. Bitcoin, for example, can rely on a very predictable automated process. The only variations come from how much money I move, when I move it, and where I move it. Bitcoin also can rely on a repeatable process. People don’t just move money once in their life. People tend to move money regularly. You might work in one country but your family lives in another. You might move money every month through your paycheck. Or each time you deposit a paycheck, you might also pay off certain bills. So all of that gets repeated, over and over.

And then a third important characteristic here comes from blockchain’s immutability, its making of a permanent record. We need to know without any doubt that I no longer have the money that I sent to you, and that you definitely do have the money. If we don’t have a reliable record of that transaction, we might run into issues. If I can go back and change the database and make it look like I still have this money even after I’ve sent it to you, that would create something known as the double-spend problem. But with this immutable record of value transfer, we both know something has moved from one place to another. We both can see that nobody has tampered with these records — unlike with central banks right now, where cyberhackers might come in and alter the one central database and steal tens of millions of dollars. The whole blockchain exchange defends against that kind of attack by offering transparency to everyone.

By extension then, and even given blockchain’s murky origins, its sometimes nefarious uses, its tendency to raise regulators’ anxiety levels, could you outline why else a broader public (not yet terribly informed about or adept with blockchain adoption) should see this technology as potentially beneficial — particularly in terms of personal privacy, institutional transparency, and broadly distributed economic opportunity? Or perhaps in Meltem Demirors’s terms (from her forward to this book), how might blockchain substantively reshape the status quo, pointing in the directions of enhanced choice, consent, agency?

I like to point out that we’ve had the basic elements of blockchain for decades. But only within the past five years did we reach a moment when people suddenly began to realize and appreciate what they could do with blockchain. Naturally this has made regulators anxious. Somebody gets nervous with basically every innovation we’ve ever seen. The Internet and the World Wide Web and e-commerce made a lot of people at first say: “No way am I putting my credit-card number into this computer.” People at first felt nervous using mobile apps’ ride-hailing services, but then we all got used to these apps. Sure, some regulators and even ordinary citizens might think: Ooh, Bitcoin. Don’t only the bad guys use that? Well, no. Like any technology, we can use cryptocurrencies for good or for ill. Especially at a time when public trust has reached an all-time low, we can use blockchain to build digital trust, and to create new kinds of institutions that people can believe in again.

For example, hackers have stolen millions of American citizens’ personal data. The US military recently announced that the Chinese military conducted the Equifax hack. When all of this very private information gets stolen by another government and potentially used against us, that creates a lot of anxiety. And blockchain provides one clear way to better manage and secure that personal data.

Another basic challenge, in the US especially, has to do with our medical records. If you’ve ever tried to see a doctor or go to a hospital outside of your regular network, you know that accessing and sharing your medical records, even when you really need them, can get extremely difficult. Health-record companies in this country have deliberately made their systems incompatible with each other. They’ve taken your very sensitive personal-health data and locked it up behind a wall. But blockchain technology has the potential to break down those walls in a safe and secure fashion, so that you can control your own data again. You can protect it better, and decide who can look at it and who can’t. Most importantly, you can see an immutable record of who has looked at your data. Today, sitting here right now reading this conversation, you have no idea who might be looking at your data, and who has looked at it many times before. But in the blockchain future, you could personally track that and make decisions about it. And the importance of those decisions of course has only been compounded by the public-health demands of this COVID-19 pandemic.

So to stick with healthcare, how else might applying blockchain technologies produce direct patient and institutional benefits: say in terms of promoting patient-centric approaches (as opposed to professionally siloed treatments, or to those proprietary corporate claims you just mentioned), and prompting provider best practices (by reducing procedural errors due to data slippages), and diminishing equivalent possibilities for waste or fraud? At the same time, what dangers might arise due to how potentially poor-quality data might forever shape one’s immutable record, or due to newly monetizable forms of patient profiling?

Right, you can read a lot in the business press about how blockchain has started to reshape financial services, but in our data-intensive, three-trillion-dollar US healthcare industry, we also have a lot of opportunities right now for blockchain to help solve real problems. For example, again just in terms of access, instead of having healthcare anchored in the hospital or doctor, we can invert that discussion and instead anchor healthcare in the patient, and have the patient be the organizing principle that everything else wraps around. Blockchain can help to unlock and to track all this patient data already existing in various parts of the healthcare system.

Blockchain also can help in exciting ways with medical research. Today, for example, when Pfizer or Novartis or Johnson & Johnson seeks to develop a new drug, 80 percent of the attempted drugs fail. One of these companies might spend five billion dollars to get a new drug onto the market, but that really means spending one billion on the successful drug and four billion on a whole bunch of unsuccessful efforts. And as an unintended consequence, Big Pharma companies also have vast repositories of data on what didn’t work. Right now they treat this as proprietary data and keep it secret. So when one company attempts to develop a new drug, they might try a bunch of unsuccessful approaches that someone else already has tried. But with certain blockchain applications, the pharmaceutical industry could start to share much of that so-called unproductive research, and ultimately bring new useful drugs to the market much cheaper and much faster. MIT researchers have developed a model suggesting that the industry could create drugs 50-percent faster while spending 50-percent less money. Instead of life-saving drugs taking the current average of 15 years to get into patients’ hands, we can start saving lives in seven years. Think of how this could transform the lives of whole families all around the country currently dealing with lethal illnesses.

Healthcare also does, as you suggested, provide a useful space for thinking about potential problems related to blockchain data quality. Blockchain’s permanent record does have this potential flip side. If someone either accidentally or deliberately puts bad data into the immutable record, then we’ve got a problem — and with inaccurate healthcare data perhaps life-threatening. What if a provider fails to enter a drug allergy into your record, and then everybody else assumes they can give you that drug? So we do need to spend more time thinking and talking about how to improve data quality even before we put this data into blockchains. And then if poor data does get added to a blockchain, we need to have technological fixes already in place. We have some smart people starting to think about those problems, but we need many more.

Could you then describe some mixed blessings blockchain likewise does bring to financial institutions and their customers, particularly given this industry’s fundamental reliance on trustworthy record-keeping for productive resource allocation — alongside its historical (but not inevitable) dependence on “layers upon layers” of professional intermediaries to ensure and broker that trust? Who stands to gain the most and to lose the most as our vernacular conception of what a “bank” is or does potentially becomes obsolete (with, as you note, many skilled executives already quickly relocating to blockchain-driven companies)?

We already can see the financial-services industry writ large (which includes banking and asset management, trading, insurance) undergoing seismic, once-a-century change, due to new technologies like blockchain and artificial intelligence and Big Data analytics. As all of these elements get combined, financial-services employment could plummet by 50 percent or more within just the next five years. So let’s say that today you need an insurance broker, to help you find some insurance. The insurance company then writes your policy. Maybe a managing agent in the middle then helps with the underwriting. The insurance agency then might sell off the risk to a reinsurance company, who, in turn, might securitize it and sell it to investors, and so on. A whole bunch of hands get into the pie when you take out insurance. Then when your car gets into an accident and you make a claim, the claims-adjuster needs to come look at the car and give you an estimate and write the claim before you get paid. A payment agent working for the insurance company then helps to transfer your money. But in a blockchain- and AI-enabled future, almost all of those tasks and occupations could get replaced by automated computer systems.

Insurance policies create a pool of risk. A bunch of people put some money into a big pot, on the expectation that they as individuals probably won’t get into an accident — but that, if they do, they can take enough money out of that pot to cover it. This is how mutual insurance has worked now for a long time. But blockchain could serve as that basic intermediary, instead of all these brokers and agents and their various filings and claims. You and a thousand other people can pool your money on a digital ledger, on a blockchain, and then if you get into a car accident, you can pull out your phone and take a picture of the accident with an app. AI can analyze the picture and say: “Yes, that looks like a real accident and will cost this much.” And then the AI can tell the blockchain system: “Pay the person this much money,” and your claim can get adjudicated entirely by computers. That would further contribute to almost every insurance-industry employee becoming obsolete. These blockchain operations would need a few senior people who design the risk models, and some computer programmers designing the system. And of course I’m oversimplifying a bit here, but not by much.

Similarly, you can run a digital bank with one-tenth as many people as a regular bank. So if you work in the financial-services industry today, hopefully you’re doing everything you can to acquire new skills and learn about new technologies. Blockchain is one of the major technologies driving the need for that change.

Both energy and food production likewise find themselves primed for blockchain applications, especially around questions of provenance. Could you describe how increased concerns about the ecological/ethical footprint and sourcing of these industries, combined with persistent needs to coordinate complex supply chains on a compressed timeline for their particular products, crystallize here in two clear examples of diffuse (and elaborately regulated) markets today needing to push beyond quite antiquated recording, tracking, and compliance mechanisms?

Absolutely. So blockchain has many applications beyond just financial services and healthcare. Food and energy markets, with their complex supply chains and many intermediaries, definitely stand out. We’ve seen lots of headlines about E. coli scares, with whole populations told not to eat lettuce, for example. These food-contamination problems come up from time to time in our very complex and interdependent food-production system, with many different hands literally touching your lettuce. For now, even when we need to figure out quickly where the contamination comes from, we still rely on a mix of paperwork and electronic systems. But major grocery chains like Walmart and Carrefour have started adopting blockchain to track questions of provenance (a fancy word basically for: “Where did this come from?”).

Many people today consider the provenance of food critical to personal health, and to the health of our environment. We want to avoid those contamination cases, but we also might want ethically sourced food meeting certain organic criteria, or grown in certain humane conditions — such as with free-range chickens instead of chickens cooped up in tiny pens. Certain buyers will pay a premium for ethically sourced food. But that also means certain sellers will try to counterfeit ethically sourced food. So now we need an even more complex way to assure customers on all of these details about what they put into their mouths, and their bodies.

Food production of course has a lot of time-dependent characteristics. If you can’t deal with all of this information rapidly, a lot of food goes bad, and you have to throw it out. Energy production has similar dynamics. You start with very localized production. You then transport it to another place. You have many intermediaries. And unless you’ve developed really great batteries, the energy might disappear or get used up. We definitely need more work on improving storage technology. For sources like solar right now, once you generate it, you can only store so much. So when the sun comes out, you want to put as much of that energy as possible onto the grid, but then how do you account for that?

We also now see many neighborhood microgrids. With California’s recent fires, for example, some Native American reservations have begun to generate their own power, and to provision it through their microgrid, even as large portions of the state go dark. So other communities have started looking at that and saying: “Hey, we’d like to generate our own power as well.” And how do you manage all these microgrids, so that they connect effectively with each other? Again this requires an accounting mechanism for lots of intermediaries, lots of parties, and for keeping track of complex information in a way everybody can trust. If someone says: “Okay, I produced this electricity, and you used it, and now I want to get paid on that,” we need a quick, efficient, cost-effective way to manage that exchange. Many related potential conflicts come up right now as we try to rebuild our fragile US energy grid and make it more resilient, and to generate new economic development around it.

Yeah, in terms of building through or building up blockchain technologies, and with all these solid examples of blockchain’s real-world significance, we haven’t yet addressed the simultaneous presence of overinflated blockchain hype. Here could you flesh out what makes blockchain “both more, and less, than it is purported to be” today? And while acknowledging, say, coin-offering enterprises’ need to maintain interest and stability in the issuance and pricing of their securities, could you nonetheless point to what you find most problematic as such firms depart from open-source community models in pursuit of more exuberant investor relations?

On one hand, I think we have only begun to see the potential impact blockchain can have on business, on society, on our everyday lives. From that perspective, I’d place us in the first or second inning of this baseball game. On the other hand, I do see some folks in the blockchain industry running around anticipating the trends and proclaiming the future a bit too much. Instead of pointing to what blockchain might help us do seven years from now, they’ll describe those possibilities in the present tense. So the hype has sort of run away from us in a few areas. Blockchain has so many potential applications. But you don’t always need a blockchain. Sometimes companies will build one anyway today, just so they can say they’ve got a blockchain.

Over-exuberance also plays out in how some of these companies fund themselves. Remember that blockchain began with digital currency, with money. Blockchains started issuing these tokens, but governments consider that their own domain. It costs the US government around five cents to make a dollar bill, which they then sell for a dollar. This difference between the currency’s cost of production and its nominal face value is known as seigniorage. Seigniorage helps governments to fund their budgets.

Similarly, these blockchain companies started creating new currencies, which didn’t cost very much to make, and which started to rise in value. That became this new way to raise money for your startup without having many people take equity in your business and bring about investor dilution. I can think, for example, of one particular company that raised 50 million dollars without any investor dilution — all through a coin (or token) offering. And inevitably, certain participants got really excited about finding these new ways to fund innovation, to fund startup companies, to basically sell a promise that someday these tokens will have gained value because of their connection to something else invented by this company.

Well, this all sounds great, except that in some of these token markets people have engaged in a lot of hype-making. In the securities industry, we call this “investor relations.” And with digital tokens in particular, many folks who consider themselves revolutionaries reinventing the financial-services industry have decided (incorrectly) that securities laws don’t apply to them. They’ve cultivated what we can call investor relations, but without registering their security or engaging in any formal dialogue with regulators.

This has caused a lot of heartache, with companies not just failing to report raising lots of money, but making exaggerated claims about their business potential, or failing to disclose risks. In the US, the Securities and Exchange Commission and the Commodities Futures Trading Commission have now taken some action. People used to abusing these systems have started to get a wake-up call. For a time, certain self-promoters just kept making wilder and wilder claims, to try to get someone excited enough to buy their digital token. So in that way, I would describe blockchain today as a lot less than what many people have felt economically incentivized to say it was. But at the same time, if we look seven or 10 years into the future, I sense we’ll see blockchain doing many things we still can’t quite anticipate.

Here could you also sketch a few basic medium-term challenges facing blockchain technologies: particularly regarding questions of how to scale operations, how to enhance computational speed and power, how to reduce the corresponding ecological footprint, and how to effectively govern themselves — all amid looming possibilities for increased corporate concentration, for regulatory (or even more clandestine) constraint imposed by anxious government authorities, and for fractious discord among a dispersed range of participants?

Again, we have lots of different flavors of blockchains, and some grow big or scale up better than others. Bitcoin, for example, scales very slowly — or as it scales, it actually slows down, because of its intrinsic security-enhancing design. You may have to wait 10 minutes, 20 minutes, half an hour, or even a couple hours at peak volume for a transaction to clear. If you want to wire money, that probably doesn’t matter much, because you’ll still move faster than traditional money wires today. But if you try to do something more mission-critical, like accessing health records in an emergency, you can’t just wait around two hours. You need those records right away. So the industry already has developed different computational solutions for different kinds of blockchains. Blockchains have started to specialize to meet specific needs. Some blockchains process transactions very fast, and at least in theory could replace what Visa and Mastercard do today — at the same huge volume or scale as Visa and Mastercard. It might still take five to seven years to design a commercially viable system that fully addresses this scaling problem, but it will happen.

Another basic problem emerges from the fact that all security comes at a price. I already mentioned these very, very secure means of handling data. Well, that requires a lot of computing power to maintain security. Blockchain defends very well, for example, against what digital-security experts call a Sybil attack — where many, many machines combine to hack into a system. But blockchain maintains this secure position at the cost of significant electricity usage. Bitcoin’s carbon footprint already hovers around a small nation’s like Sri Lanka. And you could say: “Well, that doesn’t sound so bad for a 200-billion-dollar currency.” Or you could say: “Wow, do we really need these new emissions, just so people can play around on their computers?”

So you do see right now many different efforts to make blockchain less carbon-intensive. You even see carbon-neutral or carbon-negative approaches, with some groups putting giant solar panels on top of data centers housed in high-solar areas like deserts. We definitely need more of this, since blockchain data centers require extra energy — not just for running regular computers, but for powering a whole series of mining nodes, producing ever more blockchains. And I’ll also note in passing that blockchain looks increasingly important in managing carbon credits and related ecological resources.

And then as one quick case-study of the internal dynamics making it difficult to predict even blockchain’s near-term future, could you describe the hard fork in democratic decision-making that already has bifurcated Bitcoin’s development?

Bitcoin offers this great example of a blockchain not controlled by any one person. Hundreds of people have collaborated to develop Bitcoin and make it run. These people continue to decide how to develop Bitcoin further. So, for example, a few years ago an argument played out about which changes to make to the software to address speed and scaling. Microsoft, by contrast, can just update its code, issue a new release of software, and send customers an automatic reminder to download this updated code — and then Microsoft has implemented its new software patch. Well, it doesn’t work that way with blockchain, particularly decentralized blockchains with decentralized governance (which means: most blockchains). Some do have more central control, but the blockchains without that control face this basic issue.

So when Bitcoin’s developers wanted to make it more efficient, they disagreed about how to do that. They had a vote, effectively, and roughly 10 percent of voters opted to go in a different direction from everybody else. This brought about the hard fork. Now, with computers, you fork your code all the time. When you want to run parallel processes, you basically split the code. You make at least two distinct copies, which take on two different functions. Well, in this case, the code forked into Bitcoin and Bitcoin Cash, and the code itself diverged. Everybody who held onto Bitcoin got one or other of these, and the two communities of developers went in different directions. You can consider that either a feature, or a bug, or a risk, or an opportunity with blockchains — and with how these open-source-code communities, ruled by consensus, work. No single iron fist decides.

Could you likewise discuss how certain external pressures, such as different countries’ strikingly different regulatory approaches, might prompt evolutionary forks in the development of various blockchain ecosystems? And in terms of your call for a principles-based approach (organized around the broader objectives of focusing on outcomes, protecting all stakeholders, fostering trust, promoting competition, furthering innovation, and harmonizing international policies), which societies and/or agencies do you see most proactively pursuing such principles today?

I don’t know if varied regulation will lead to actual forks, but I have seen active “domicile shopping” by certain blockchain projects, to optimize the regulatory environments in which they operate. The most nimble countries I’ve seen for adopting and encouraging blockchain include Switzerland (particularly Zurich and Zug cantons, but also Geneva), Mauritius, Singapore, Bermuda, Barbados, and some of the other Caribbean islands. The EU is adopting Euro-wide regulations, and both the Science and Technology Options Assessment Panel in the European Parliament (whom I advise) and their counterparts in the European Commission’s DG Connect have been very engaged in the discussion.

The UK, led by the Bank of England, has also pursued an active exploration of blockchain applications, particularly in financial services. I work with the UK Government to help bring about broader societal benefits from Great Britain’s academic and private-sector excellence. Canada too has quite a bit going on. I have had some dialogue with US regulators (I help advise the Financial Industry Regulatory Authority), but in general the US financial-system apparatus has lagged behind Europe, Asia, and elsewhere in blockchain adoption.

With governmental agencies still in mind, could you also introduce this book’s account of what highly distributed decision-making (among a diverse range of actors and stakeholders) might look like in the medium-term future — particularly as rates of technological innovation continue outpacing our present capacities for effective organizational response? And how might you unpack this book’s basic formulations that “Holacracy is well-suited to the open source inspired world of blockchain,” and that “blockchain, in turn, can help make holacracy more viable”?

The remote work and contingency governmental activities that COVID-19 already has required have changed everything about how we live and operate in the short term, and may accelerate adoption of new distributed models in the longer term. We may see more use of distributed and of automated decision-making as individuals seek to maintain social activity, and as societies seek to stay economically productive — all in an environment that lacks the benefits of interacting and working in person. Crisis is promoting technology adoption at a rate not previously seen.

Then to answer your question’s second part: open-source projects have a certain self-organizing component to them. These dynamics play out in a field called “complex adaptive systems.” You have many individual actors working on semi-related problems, in an interconnected but loosely coordinated manner. You have more closely managed open-source projects, and more loosely managed projects, but with both ends of this spectrum characterized by ecosystems combining many small contributions to accomplish some larger overall goal. In that sense, holacracy can provide an anti-authoritarian and self-organizing management system, well-suited to governing an open-source project such as a blockchain. Not all blockchain protocols are open-source, by any means, but those that are (including Bitcoin) promote trust in the code because this code remains openly available.

And now flipping that script, holacracy would manage a corporation somewhat similarly — swarming resources around a problem, without imposing any rigid authority structure. In order to do this effectively, you need flexible information systems. You need ready dissemination of data to numerous people. Blockchain is by no means the only kind of database that can do this, but it does offer one compelling solution.

Similarly, how might distributed-management models make blockchains themselves more effectively governed?

Well today, many blockchains handle governance through mixed modes. Conversations on messenger apps like Telegram or Signal or WhatsApp in turn lead to voting activity among blockchain nodes. We might see some of this become a bit more seamless and fluid, with AI agents empowered by node owner/managers to follow certain guidelines on what to do in different circumstances. Bear in mind, a lot of blockchain-management decisions get made quite sparsely (for instance, the decisions about forking Bitcoin), rather than daily or several times each day. If aspects of governance requiring more rapid decisions were to receive widespread adoption, we might see decision-making mechanisms acquire greater efficiency — including in the code design of blockchain protocols.

That takes us to the foundational role played by publicly supported academic initiatives in catalyzing blockchain innovations and applications: from basic research all the way to real-world corporate and social-entrepreneurial enterprises. Here could you likewise describe what blockchain can do for academia — particularly in terms of coordinating trust-building credentialization mechanisms across a wide variety of participants, or encouraging transdisciplinary collaboration across a wide range of research fields and institutional bodies?

The first area where we’ve seen blockchain applied to academic operations has been in the issuance of credentials, with digital certification proving that you did specific work at a particular university. Students in our online classes and programs at Oxford receive these digital certifications upon successful completion. Going forward, whether in terms of research teams sharing ideas and coordinating activity better, or of institutions tracing intellectual property and getting paid better royalties for university inventions, blockchain can help the academic world to innovate in any number of ways.

Finally then, and again with COVID-19’s longer-term impacts in mind, how might the group- and project-oriented learning that blockchain enables anticipate our future world of increasingly dispersed and nimble classrooms and workplaces and task-based teams?

Those questions just keep getting more urgent as we potentially face an extended period during which both work and university learning will often happen virtually. So how can we do a better job of collaborating at a distance? The best (deepest, most enduring) learning takes place when you participate on a project-based team. So how can we provide a distance-educational environment for team-based experiential learning?

We’ll need to be able to share information rapidly, without loss of fidelity. We’ll need to be able to coordinate our activities and decisions better, even without talking face-to-face. Blockchain systems have the potential to help address these concerns. Colleagues at the MIT spinoff Endor (with which I’m tangentially involved) have used distributed ledger to get people collaboratively predicting future events. That’s pretty cool.

But other critical concerns also arise when you attempt to educate from a distance, including questions of attention span, production quality, and providing meaningful digital engagements. That already takes us beyond the content of Basic Blockchain. But I’ve tried with some very experienced colleagues to answer some of these questions through a new online class provider that partners with major universities, called Esme Learning. Another company I’m involved with, Riff Analytics, uses AI to make collaboration more effective. I’ll address some of the research and some of the principles behind these companies in my next book, Augmenting Your Career.

Ideas do interest me. But I’m especially fascinated by how we use these ideas to solve big problems. My own online classes and startups focus on stimulating people to action, and translating academic theory to real-world impact. My books are vehicles to help people work through and apply these ideas in practice.