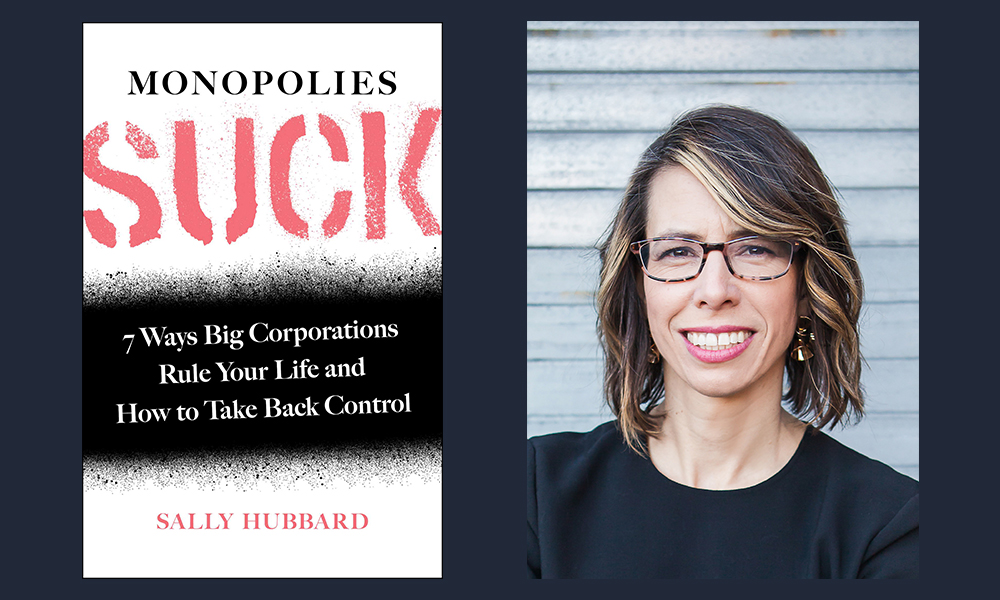

How do monopolies operate as “hidden culprits” behind so many problems plaguing us today? How can government (and why should government specifically) change that? When I want to ask such questions, I pose them to Sally Hubbard. This present conversation focuses on Hubbard’s book Monopolies Suck: 7 Ways Big Corporations Rule Your Life and How to Take Back Control. Hubbard is an antitrust expert and Director of Enforcement Strategy at the Open Markets Institute. She served as an Assistant Attorney General in the NYAG Antitrust Bureau, and has worked as an investigative journalist covering mergers, monopolies, and privacy. Hubbard has testified in the US Senate and House of Representatives, and before the Federal Trade Commission. She appears regularly in a wide range of media including The New York Times, CNN, BBC World News, Vanity Fair, The Washington Post, The Atlantic, and Wired. She hosts the podcast Women Killing It.

¤

ANDY FITCH: Your book sketches a range of ways that monopolies have played the role of a “hidden culprit” for so many Americans feeling left out, left behind, screwed over in recent decades. So could you first outline the broader case that monopolies’ rise almost inevitably means a zero-sum scenario, with their conspicuous strengths (in terms of wealth, power, rights, opportunities) coming at everybody else’s expense — as well as at the expense of future economic dynamism?

SALLY HUBBARD: Once monopolies can control the levers of economic and political power, they tend to stop being innovators and creators of value. They start becoming extractors. We’ve seen all of this before. We saw it with the original Gilded Age — a time both of unprecedented inequality and of monopoly rule. When monopolies accumulate that much power, their business models almost inevitably focus on extracting tolls from other participants in the marketplace.

Other firms (small, medium, and large) now have to do business on the monopoly’s terms, and at its prices. All of this ultimately means extracting more from consumers (by gouging them with higher prices), and extracting more from workers (who lose bargaining power), and extracting from taxpayers (because these powerful monopolies get crazy concessions from government, and don’t pay their fair share of taxes). When corporations gain unchecked market power, they almost as a rule become takers instead of makers.

So monopolies may suck, but you describe your goal here not as to demonize specific corporations, not to shame individual CEOs, so much as to pinpoint our political system’s failure to address these structural problems. Why should we place the onus not on tech platforms to police themselves, not on consumers to abstain from accessing essential 21st-century societal infrastructure, so much as on government to foster competitive marketplaces, and to proactively constrain corporations before such excesses can occur?

I don’t really believe forms of self-regulation that go against a firm’s profit incentives can succeed. If we put our faith in corporate leaders doing the right thing at the expense of profits, we’ve basically deluded ourselves about the nature of this corporate structure. We could change current interpretations of corporate law on how corporations should get governed. But those current interpretations define corporations as profit-maximizing entities — with fiduciary duties to shareholders to maximize profits.

Demonizing individual CEOs also distracts from the fact that our democratic institutions need to deal with these types of structural problems. We the people, as citizens, need to determine the rules for our economy’s proper functioning. To think that an individual CEO should behave differently doesn’t get us anywhere when it comes to addressing systemic, structural, institutional problems. Instead our democracy faces an obligation to preserve open markets, to preserve economic liberty, to promote free speech, to ensure that our marketplace of ideas doesn’t fall into the hands of a concentrated few.

You also make the broader historical case that we don’t face technological challenges driven by unprecedented winner-take-all platform dynamics, so much as a political challenge driven by today’s concentrated tech markets. And you argue that we already possess the tools required to meet this 21st-century challenge, that we just need to recommit to using these tools effectively. Could you flesh out the 20th-century example of government actions taken against AT&T — as a model for addressing, say, the market-capturing power of a cutting-edge tech firm with a corporate strategy designed to entrench network effects?

Sure. Particularly with the Big Tech platforms, people might think we face these entirely new problems, unique to the digital age. But again we’ve seen this all before. We had the same kinds of network problems with Gilded Age railroads. We obviously had a network problem with AT&T. With AT&T, we saw that antitrust plays a critical part in addressing these problems — but only as one piece of the anti-monopoly toolkit.

With AT&T, we had both antitrust enforcement and structural breakup. We also had a lot of regulatory intervention. We had requirements that AT&T interconnect with other carriers (akin to the interoperability requirements we need for today’s tech platforms). It took a lot of time and effort to put all of this in place, but we effectively combined regulatory, legislative, and antitrust enforcement to eventually rein in AT&T.

AT&T itself became more valuable as a result of antitrust enforcement. We don’t break up these monopoly corporations with the embittered hopes of destroying shareholder value. In fact, shareholder value often increases as a result of these actions. Activist investors of course break up corporations all the time. For some reason, nobody calls that a tyrannical intervention. Interventions of these sorts can lead to a burst of innovation, with lots of new dynamism and entrepreneurship. That’s what properly functioning markets provide. And we’ve figured out in the past how to open our markets back up again. It’s not as complicated as these companies would make you believe.

Well with historical precedent still in mind, could you describe a couple pivotal steps in the late-20th-century case law, taking us far from the Sherman Act’s and Clayton Act’s legislative intent? Which broader societal shifts do you see stemming from how antitrust jurisprudence has downplayed commitment to robust market competition, instead prioritizing corporate “efficiency” and supposed “consumer welfare”?

The Sherman Act had promoting competition as its basic legislative intent. The Clayton Act prohibits mergers that may lessen competition. But in practice we’ve witnessed hundreds of anti-competitive mergers getting approved in recent decades. We’ve drifted far away from these antitrust laws’ intent to promote fair competition and prevent concentrated corporate power. We’ve failed to uphold Senator Sherman’s famous statement that: “If we will not endure a king as a political power, we should not endure a king over the production, transportation, and sale of any of the necessaries of life.”

The early 1980s brought big political transformations and neoliberal policy approaches. In antitrust, the Chicago School of economics took over, making this argument that the purpose of antitrust law centers on maximizing corporate efficiency. As long as corporations keep getting more and more efficient, consumers supposedly benefit, as these corporate cost-savings supposedly translate into lower consumer prices. That core argument became the North Star for antitrust enforcement. But 40 years later, we can see how clearly it has failed.

It hasn’t even succeeded on its own questionable terms. Alongside many major industries getting highly consolidated, we’ve seen consumer prices skyrocket. It turns out that corporations attaining significant market share, and facing no real competition, have no particular reason to pass along those savings to consumers. And they certainly don’t pass these profits along to their employees. Again, the evidence for all of this has become abundantly clear.

Of course our antitrust laws never mentioned anything about efficiencies or prices in the first place. Those emphases have come at a huge cost — not just in terms of higher prices, but also of fragility and instability, and of concentrated economic and political power. This COVID pandemic has shown, for example, just how fragile our concentrated economy has become. I mean, you’d think in America we’d have enough swabs, right? But only two companies in the whole world make the swabs used for medical testing.

Or I tell a story in the book about a start-up company co-founded by Lillian Salerno, trying to pioneer a better type of syringe that prevents nurses from getting HIV. But monopolies in the industry kept this syringe completely blocked out of hospital markets. And now we see the consequences. We didn’t have enough syringes for sufficient vaccine distribution. The fragility of these “bigger is better” approaches really stands out right now. Just think of which state has done the best job so far: West Virginia, where they rely on independent pharmacies, and have declined to participate in the oligopoly pharmacy rollouts.

So now in terms of your subtitle’s seven ways big corporations rule our lives, first how else do monopolies take our money (sometimes without us detecting it)? Alongside these classic patterns of dominant economic players raising prices and extracting rents, how do, say, omnivorous data monetization, uncompensated labor (for our constant algorithm-training efforts), untaxed labor and much broader fiscal distortions (through various forms of public subsidy), all conspire to make “free” tech services from Facebook and Google, or “cheap” marketplaces like Amazon and Apple’s App Store, much more costly for everyday citizens than it might first seem?

Facebook and Google sold us this bill of goods, about their supposedly free services, which in reality track us in relentless ways that most of us never would consent to. I consider that alone a massive fraud on the American people (and, of course, on the whole world).

In public discussions of Facebook’s privacy violations, you’ll often hear someone say: “Well, you shouldn’t put your whole life on Facebook. You shouldn’t post your baby pictures.” This type of victim-blaming completely ignores the fact that what you post on social networks constitutes just a tiny fraction of the data they collect about you. Facebook uses all this data to hyper-target us with advertising (again at the expense of traditional advertising venues). Facebook makes more than a billion dollars each week by targeting us with ads, based on this extensive surveillance it does. That brings with it so many costs.

First, although many privacy advocates oppose the idea of platform users getting paid for their data, we know how little value users currently receive from its extraction. We also pay huge personal costs to our freedom, by being put under relentless surveillance. We face serious dangers of being manipulated in undetected ways. We might get charged higher prices, for example, based on these firms calculating our personal willingness to pay.

At the same time, of course, when every small business has to pay a toll to Google, in order to be discoverable in search results, where does that money come from? Small businesses often pay thousands of dollars to this one dominant search engine. And when small-business entrepreneurs, already operating on tight margins, have to bear these additional costs, they likely pass that toll onto consumers. They also might pay their workers less, or hire fewer people — again all just to cover this implicit Google tax, just so that they can appear in a Google search on their name, which should have led to them anyway (if Google’s algorithm simply provided the most relevant results).

When platforms control essential economic infrastructure, and become the gatekeepers for how businesses get to market, they can extract all kinds of tolls that ultimately get passed on to everybody else: as consumers, entrepreneurs, employees, and taxpayers — with, again, some of the biggest firms paying nothing in corporate income tax. When you add that all up, the price for these “free” services often rises incredibly high.

Similarly, in terms of monopolies gouging us when we’re sick, why do we need to consider their role not just in glaring inefficiencies of the US health-insurance model, or sensational episodes of spiking EpiPen prices, but in the ever-rising costs of premiums, deductibles, care, prescriptions? And then how does our corresponding insurance dependency further diminish both personal freedom and broader economic dynamism?

So obviously the US health-care system needs a lot of reform. Our government, for example, often pays corporate asking prices for drugs — which really no other country in the world does. But alongside these big, society-wide changes, we need significant change in how health-care markets get structured. So many built-in features now cause anti-competitive behavior to thrive, and lead to higher costs for us all.

One of the biggest drivers for rising costs actually comes from local hospital monopolies extracting high prices from insurance companies. When your premium goes up again, you might blame your insurance company. But hospital monopolies also deserve a large portion of the blame. We’ve had close to a hundred hospital mergers per year. We’ve had rampant consolidation, which has led not to broadly distributed efficiency gains, but to less choices and lower quality for patients. It has depressed nurses’ and other health-care workers’ wages. And it also means health-insurance companies have to pay exorbitant prices — because no insurance company can cover you if it refuses to work with the hospital monopoly in your town.

Insurance companies then merge with each other, in order to have more bargaining power against the hospitals. We see this happen in many industries where bargaining power plays an important part in price-setting. Consolidation begets more consolidation. Everybody keeps bulking up to gain more leverage in their bargaining. In the end, the individual consumer (here the patient) gets screwed. I mean, between 1999 and 2016 employees’ insurance premiums rose by 242 percent. It’s just astronomical.

A lot of my work in the New York Attorney General’s office focused on anti-competitive behavior by Big Pharma. For just one quick example, branded Big Pharma companies pay generic companies large sums just to stay out of the market, just so that consumers don’t have access to low-priced life-saving drugs. These generic companies get paid basically not to compete. We’ve made some important reforms around this, but still have a long way to go. Antitrust enforcement penalties alone can’t take us there, because a pharmaceutical company with a blockbuster drug that brings in billions of dollars each year can easily afford to pay a couple hundred million in fines to get to keep violating the antitrust laws.

Again, that’s just one of many ways that today’s anti-competitive behavior has caused health-care costs to skyrocket. And every American can feel this weight on their shoulders, right? I mean, the boomer generation benefited from decades of antimonopoly policies and strong antitrust enforcement, before the kinds of change that came in the early 80s. Back then, you didn’t face this soul-crushing struggle just to pay for a basic essential like health-care. You didn’t have these potentially endless medical expenses haunting you. You could start a business. You could venture out on your own, with much less apprehension than working-age people feel today.

Entrepreneurship provides a critical pathway to the middle class. But anyone who wants to start their own business today first has to ask themselves: “Can I afford it?” I’ve done this same calculation. I’ve had to factor in the huge cost of health-care for a family of four. And would-be entrepreneurs of course also have to factor in the costs for employees’ benefits. That all puts a heavy drag on economic innovation. One study found that spouses whose partner can cover health insurance start up new enterprises much more frequently. For everybody else, this just means more lost dynamism.

Then combined with the acute economic pressures of globalization and automation, which consequences of diminished labor-market bargaining power stand out as most damaging — both for displaced manufacturing workers routinely profiled in recent years, and even for significantly younger workers seemingly well-equipped for today’s economy?

Today many of us work harder than ever, for longer hours, while receiving a diminishing share of the value we create. One graph in the book shows how workers have become so much more productive in recent decades, while capturing a smaller and smaller share of this value they create — with most of it going to C-suite executives and major shareholders. When you can feel this ubiquitous sense of everyone getting overworked, overwhelmed, burned out, while still unable to meet basic needs, that means we’re being squeezed on one side by monopoly prices, while squeezed on the other side by wage stagnation and increasingly demanding working conditions.

I don’t want to sound too nostalgic about the days of many single-worker families, because I see much good in more women entering the workforce since the 1980s. But the idea of just one parent working, maybe 40 hours a week, with everyone home for 5 o’clock dinner, with no work left over for the evenings or weekends, with families having enough to eat and solid health-care and putting their kids through college — that all just sounds like a distant, utopian, middle-class dream at this point (but it wasn’t). Today, even in households with two workers, with work that doesn’t ever stop, people still struggle to meet their basic needs. So that’s what I consider most damaging, that ubiquitous financial stress that comes with this lack of bargaining power: with so many individual workers today doing the jobs of several people, with little mobility to escape these oppressive conditions, with so few employers and options.

Today’s monopolies of course also spy on us and manipulate us, as basic components of their business models. How do, say, engagement-prioritizing algorithms, by their very nature, serve to popularize addictive feedback loops of fear, anger, and extremism? And what could more benign algorithmic operations here look like (if, of course, we somehow prevented Facebook and Google from blocking or buying them)?

That takes us back to this book’s major theme: when monopolies don’t face competition, they screw you over. When our neighborhood only has one cable provider, that provider keeps raising the rates. They tell us their service operator will show up sometime within a 12-hour window [Laughter]. We viscerally feel taken advantage of, right? But I’d say that today’s tech-platform monopolies treat us far worse. Extracting huge tolls from businesses of all sizes, they intensify our economic distress — by contributing to everything costing so much, and to us not making enough money. But they also add further psychological and social stresses, with a huge percentage of the web’s content now filtered through algorithms deliberately designed to make us feel pissed off and scared and angry and hateful. How could that daily dose of additional stress not play a big role in the constant political crises we have right now?

These business models need to face some reckoning for their role in last month’s insurrection. These platforms’ algorithms prioritize content that makes you react, which they call “engagement.” And with each reaction, this extensive surveillance apparatus (for you and billions of other people) learns a bit better precisely what pushes your buttons. At the same time, those black-box algorithms shield tech companies from accountability. They can track not just which shoes Sally’s most susceptible to buy, but which dabblers in anti-vaxxer conversations will most likely click on QAnon content. Facebook’s own internal study in 2016 found that its algorithms had done the work to recruit 64 percent of extremist groups’ members.

Facebook occasionally taking down some harmful QAnon post won’t suffice. Facebook (and I’d like to include YouTube, which has its own gatekeeping function) actively fuels these movements. A little more censorship won’t solve this problem, and creates political dangers in its own right. We need significantly less concentrated control of our public speech. When you have gatekeepers like that, you have a monopoly problem. Competition and regulation, when brought together effectively, are what keep us all from being abused by profit motives. Consumers need alternatives, and those alternatives shouldn’t just be other Facebook or Google products.

So yes, even before these digital platforms appeared in our lives, escalating polarization had become a problem. Yes, we already had Fox News (which itself pointed to a consolidation problem in news). But the particular polarization ripping American society to shreds right now stems from a business decision, happening in an antitrust vacuum. The Internet doesn’t just have to be this way. It’s long past time for our government to say: “We can’t accept these consequences equivalent to a factory spewing tons of toxic smoke. You might find this current arrangement more profitable, but we just can’t allow it.” We need rules limiting surveillance, and preventing such granular hyper-targeting, and prohibiting this algorithmic amplification for whatever gets a reaction out of people. With our democracy really at risk today, we need this combination of regulatory reform and antitrust enforcement.

And we do have, as you asked, alternative ways that social-media algorithms can deliver content. For one obvious example, you probably remember that social-media feeds did in fact at one time mostly just offer chronological content from the people you had chosen to follow. Jack Dorsey actually recommended something similar in his recent congressional testimony. You could have, for instance, algorithmic options. You already can in fact opt on Twitter to just get chronologically arranged content in your news feed. But it’s not easy to detect this option.

So we can have algorithmic competition. We can have alternatives for consumers who say: “You know what? I’d like to participate in a social-media network that doesn’t amplify misinformation and recruit people to extremism.” Real alternatives would be very helpful — again beyond certain users getting angry at Facebook, and shifting to another Facebook product like Instagram.

So in pursuit of profits, Big Tech firms have assembled this broader architecture of surveillance, with little public oversight and little long-term concern about the civilizational consequences. Again, in what ways does this whole dystopic outcome stem not from runaway technologies or malevolent corporations, so much as from faulty policy choices? And why might pro-competition measures do even more than targeted privacy protections to dismantle this spy net?

Well first I would say that we need both. But yeah, for this spy net, Facebook and Google dominate digital advertising because nobody else has a surveillance architecture like theirs. No news corporation, no individual publisher, can track everything you do, everywhere you go, everything you buy, everybody you see, every friend you have — and then aggregate this with the data collected from billions of other people, all to target you in such a precise way. Nobody else can profile you like that, whether or not you personally use Facebook for social media or Google for search. So the vast majority of digital-advertising dollars goes to Facebook or Google, and we lose a vital component of our democracy (the free press) along the way. We need both to regulate this surveillance and to open up this market, so that privacy-protecting innovators can compete.

Every day I learn about a new innovator coming forward with a different model, trying to create a decentralized Internet, a privacy-protecting infrastructure. But we need active government intervention to give these alternatives a shot at succeeding. The Big Tech companies have perfected their copy-acquire-kill strategy for any potential challenger. To open up those gates to competition, we need government to allow privacy-protecting innovators to access these walled-off gardens, again with interoperability requirements as one basic component of that. We need to eliminate the kill zones where any company daring to challenge tech giants just gets squashed — or, more often, can’t get funded in the first place.

At the same time, today’s concentrated corporate monopolies of course possess tremendous political power. They’re currently trying to draft a weak federal privacy law that can preempt stronger state law. And given their lobbying resources, they definitely might succeed.

In terms of threats to democratic self-rule, how does agricultural monopoly power likewise extend its compulsory, near-tyrannical control deep into individual lives and community structures, even in some of our nation’s most decentralized locales? And instead of efficiently providing a bountiful cornucopia, how do the resulting species monocultures and consolidated production/distribution chains make our civilizational fabric much more brittle?

Right, Big Ag doesn’t get as much attention as Big Tech in the popular discourse. But Big Ag has created an incredibly monopolized sector, with particular dangers for our food supply. Big Ag methods also mean huge contributions to global climate change. We have farmers who want to implement more sustainable and humane methods, who want to do organic farming, who want to help with climate mitigation — and just have no freedom to do any of that. Monopoly rule takes away their freedom to choose how they grow their crops, how they raise their animals.

To be honest, Bayer-Monsanto itself has become a Big Tech platform. It puts sensors in farmers’ fields. It extracts valuable knowledge that should belong to these farmers. It then tells them, based on this data collection, how much seed or pesticide they need to buy from Bayer-Monsanto. Conflicts of interest don’t get much clearer than that tremendous power imbalance.

Then the whole distribution chain also has become so consolidated. If farmers want to try better agricultural practices, they can’t bring their products to market. From, say, meat-packing to the grocery store, each step of this process has become so monopolized that everyone has to play by the rules of just a few companies.

Americans who don’t farm might think none of this matters in their own lives. But everybody’s an eater. We all end up with fewer options for how our food gets produced. We all end up paying higher prices. At this point, I think every major protein has been under investigation for price-fixing. With so few companies, they can easily find a way to collude on prices. In the book I offer just outrageous statistics on how much the price of poultry has risen — again with those profits coming right out of Americans’ pockets, both as individual producers and as consumers. For rural communities to thrive in a more sustainable economy, we’ll really need to de-concentrate the power of Big Ag.

And with monopolies ramping up so many harmful social inequalities, what makes trying to combat such disparities a “fool’s errand” if we don’t simultaneously dismantle concentrated market power? Why does it make structural sense to link, for instance, gender equity to robust antitrust enforcement?

You know, for years I got pushback on this basic notion that monopoly amplifes inequality. It seems like an incredibly obvious point that concentrated power means the exact opposite of distributed power. When you take economic and political power and put it in the hands of just a few, how could everybody else not lose out? And of course, as #MeToo has illustrated, when concentrated labor markets don’t offer much mobility, that has an even bigger impact on women and people of color and any group already likely to be marginalized or mistreated in the workplace. But when I published an article years ago about how monopoly power amplifies gender inequality, a lot of the antitrust crowd just dismissed it — again because they only thought about antitrust in terms of corporate efficiency.

Here what sorts of vast untapped market potential do we also have to assume gets overlooked by homogeneous decision-making when it comes to, say, investment capital?

With start-ups facing serious consequences for challenging a tech giant or a big monopoly, they often can’t get funded. The sources of capital, the VCs, say: “You’ll just get squashed.” The more viable model for innovation involves avoiding taking on any big monopoly in its core offerings. Instead you just add a nice little feature, or maybe place the slightest little thorn in some monopoly’s side — and, in either case, hope they’ll want to buy you.

So the prevailing innovation model right now really has become innovation towards further concentration. It becomes incredibly difficult in this environment to try to build up some great big disruptive company eventually heading to an IPO. Most funded start-ups today pursue a much more narrow view of innovation within existing monopoly frameworks.

That leaves us stuck with the four guys running the Big Tech platforms, and what they think we all need, and not noticing their own blind spots. So no surprise we see tremendous saturation for innovations serving the needs of well-off white men — whereas women entrepreneurs, especially those seeking to serve needs that women primarily experience, struggle to get funded.

I tell the story about Lynn Perkins, who founded UrbanSitter, needing to show significant market traction before she ever could get substantial funding. She already had acquired a big customer base, but still with a lot of male VCs saying: “Well, I just don’t see this problem of needing our funding, just to help people find a babysitter.” Most likely, they didn’t hire the babysitters in their own families, right? So they simply didn’t recognize the need, and also failed to recognize the business opportunity. That’s a big part of why you see these minimal rates of funding go to women and entrepreneurs of color.

Now for your book’s “How to Stop Monopolies” section, could you first point to how even Europe’s much more robust GDPR framework so far has proved insufficient through its imposition of steep-sounding fines (suggesting in fact its lack of leverage to really reshape Big Tech business models)? And could you articulate why our regulatory system needs to inflict some PAIN on these business models: say through substantive privacy rules, antitrust enforcement, interoperability (not just portability) requirements, and non-discrimination rules (when it comes to gatekeeping platforms’ predatorial practices)?

I admire Europe’s GDPR efforts on privacy violations, and how the European Commission has gone after monopolies like Google. But you can see these interventions still falling short when it comes to remedies. Just as with Big Pharma, we can’t rely on a system of fines to deter these Big Tech platforms bringing in a billion dollars plus each week. Paying fines then becomes just a rational cost of doing business. Breaking the law pays off.

So we can’t rely solely on fines. And we’ve gone so far in allowing these tremendous conglomerates to form, with so many different levers they can push to distort competition, with it now insufficient to say “Stop this particular behavior” — because the tech giants then just shift to a slightly different behavior that will achieve the same anti-competitive ends.

So I really do think we need structural separation. We need vertical separations, to separate the platform layer from the commerce layer. When Amazon operates as the platform, it shouldn’t also sell on that platform. And then we also need to look at horizontal separations, so that the company controlling the largest cloud provider doesn’t also control the largest marketplace. We need to look at all kinds of possible structural separations. Again, activist investors do this all the time. Separation of these sorts usually leads to more innovation and more value. On the societal scale, we definitely have an innovation decline right now, with just a few companies ruling entire markets. So we’ll need those structural separations, and then ongoing monitoring for anti-competitive behavior, plus much stronger merger enforcement, plus particularly clear bright-line rules about certain mergers that shouldn’t even be considered.

Senator Amy Klobuchar recently introduced a bill, The Competition and Antitrust Law Enforcement Reform Act, that presumes certain mega-mergers are anti-competitive, and shifts the burden on the merging corporations to prove otherwise by a preponderance of the evidence. Under such a tough standard, once a firm reaches a certain size, it would in most cases have to innovate in order to keep growing, rather than acquire complementary or rival corporations.

Then with those PAIN measures in mind, I should add an emphasis on banning hyper-targeting, and requiring algorithmic transparency. And on top of all these antitrust and regulatory responses, we also of course need campaign-finance reform, and anti-corruption reform, and related measures to get money out of politics — to ensure that elected representatives serve their communities instead of corporate power.

Here in terms of legislative initiatives, what stands out most for moving us beyond 20th-century case law when it comes to 21st-century monopoly leveraging and platform privilege?

We need real legislative reform that makes antitrust cases easier to win — that rolls back certain terrible decisions from recent decades which have only served to entrench concentrated corporate power. We also need new legislative strategies. Representative David Cicilline has proposed looking at the Glass-Steagall Act as a model for structural separation. We have multiple models from various industries. We did it in banking with Glass-Steagall, when significant conflicts of interest arose.

So with Google, for example, having established control over almost every aspect of the Ad Tech ecosystem, the easiest analogy might come from insider trading and from controlling both the stock exchange’s sell side and buy side. We’ve dealt with this kind of problem in other economic sectors, and figured out dynamic ways to restructure them.

And of course I say all of this at a moment when we have the rare opportunity to really reimagine what our political economy could look like. COVID has shown us how weak and fragile and unfair this concentrated economy has become. So we need to creatively re-envision how to structure markets in ways that proactively distribute economic and political power. That all feels newly attainable today. Crises present these opportunities for transformative change, for innovative system-wide thinking.

Where might you also see room for creative strategies from antitrust enforcers — say when it comes to promoting human-welfare standards, rather than consumer-welfare standards? And more personally, how did your own vantage on antitrust possibilities shift as you stepped away from pursuing individual cases, and considered the broader societal picture?

As an antitrust enforcer, you can get mired down in the details of litigation. You also can get stuck on the question of: “Which case can I win?” But with our antitrust laws weakened over the past 40 years, the antitrust cases we can win become fewer and much less ambitious. So only once I stepped away from just focusing on winnable cases could I look at the big picture and ask myself: “What biggest harms do I see? What would it take to address these biggest concentration problems in our society?”

The easiest cases to win, Sherman Act Section 1 cases, stem from an explicit agreement among companies to restrain trade, say by charging the same price or dividing up the market. So a lot of energy goes into price-fixing cases and market-allocation cases. But Sherman Act Section 2 prohibits monopolization. Those important Section 2 cases have been much harder to win. So where do we end up? Well, eventually we end up with monopoly rule across every economic sector. I’d say that enforcers need to be creative and aggressive and willing to lose cases. The standard can’t be: “Which case will we win?” You don’t see that in other areas. You don’t see enforcers saying: “I’ll only pursue the murder cases I know I will win.”

So for making this Monopolies Suck agenda palatable to the broadest range of American voters, what specific pitch might you offer to conservatives on why a “free” market does not equate to an unregulated market — so much as to a pro-competition, antitrust framework?

I actually think anti-monopoly is one of the very few bipartisan issues today. The Democratic and Republican state Attorneys General might have filed separate lawsuits against Google, but we see significant enforcement from both sides of the political spectrum. We had the cases brought against Google and Facebook by the Trump administration in its final months. I fully expect the Biden administration to continue and to strengthen those cases, and to build up a bipartisan coalition for more effectively enforcing antitrust law.

In Congress, we right now have several Republican lawmakers incredibly concerned about concentrated economic power. I mean, traditional conservatives typically distrust concentrated power, right? So I do consider this an issue that Americans can unite around. We all get screwed by monopoly power. The resulting inequalities feed into dangerous social tensions. Fascist strongmen typically gain power during times of scarcity and need and bitter divisions. Suffering people, when feeling little sense of agency or hope, have the tendency to look for a savior. Everyone on a progressive-moderate-conservative spectrum should see the value today in bringing hope and prosperity and opportunity (and along the way, a greater sense of unity) to all Americans.