When does a high-performing firm inevitably start pursuing political power? When do the goods or services it buys or sells start bringing along their own forms of coercive governance? When I want to ask such questions, I pose them to Zephyr Teachout. This present conversation focuses on Teachout’s book Break ‘Em Up: Recovering Our Freedom from Big Ag, Big Tech, and Big Money. Teachout is an attorney, political activist, and antitrust and corruption expert. Her 2018 campaign for New York Attorney General was endorsed by Bernie Sanders, The New York Times, and many others. Teachout participated on the team of lawyers who sued Donald Trump for violating the Constitution’s emoluments clause. She serves on the Open Markets Institute’s board of directors, and teaches law at Fordham University.

¤

ANDY FITCH: Could we start with what Break ‘Em Up characterizes as a collective delusion plaguing many political scientists and economists over the past few decades — the presumption that private corporations single-mindedly pursue profits, more or less indifferent to political power? And could we take up by contrast, for instance, a prevailing business-school culture actively training entrepreneurs and investors to seek out industries and markets prone to monopolizing, entry-blocking concentrations?

ZEPHYR TEACHOUT: Well right now, we face an exciting and also scary moment, with people asking fundamental questions about democracy and the shape of power and what corporate law and antitrust law should look like. Both on left and right we have this questioning of assumptions about corporate actors purely seeking profits, and not wanting to get distracted by struggles for power. I mean, first of all, that whole perspective flies in the face of human history, right? Just read any Shakespeare play. Or have a friend. Or live in the world. You’ll quickly acquaint yourself with this incredible will to power.

Corporate leaders and big financiers haven’t magically overcome those impulses. They don’t just obsessively make as much money as possible (although they do make too much, contributing to today’s gross inequalities). They also of course seek power. You couldn’t separate the pursuit of maximum profits and maximum power if you tried. These people certainly do not try. And once you shift the lens just a bit and understand Jeff Bezos or Mark Zuckerberg as not solely profit-seeking but also power-seeking, many of their decisions make much more sense. They’ve built these institutions we now rely on, and use their hold over these institutions to keep expanding their domains, picking up more power, and further maximizing profits.

They also clearly get some joy out of the power itself, out of others seeing them exert power and make policy decisions affecting us all. They’ve placed themselves right smack at the center of our democracy. They’ve established this alternate form of government that keeps encroaching on our public sector.

Until the 1970s, a broad consensus of Americans recognized concentrated power as a genuine democratic threat. We acknowledged that corporate moguls, left to their own devices, didn’t just want to take our money, but to take control. We need to restore that sense of government always pushing back against concentrated power. Similarly, we can’t just keep deferring to a professional class of economists, applying abstract models that offer a nonsense view of human nature, and of our social motivations. We need to grapple realistically with our basic will to power on one hand. We also need to tap and to support our very real capacities for compassion and care for each other.

Still with that 1970s policy pivot in mind, could you sketch the rationale for consumer-welfare standards prioritized by prevailing late-20th-century antitrust approaches? And which most elemental social-welfare concerns do these approaches obscure — regarding, for instance, worker purchasing power, or distributed democratic/civic power?

So up until the late-70s, we had a widely shared sense of corporate or private fiefdoms posing a direct threat to democracy. We had a consensus around antitrust’s core mission to prevent power from getting concentrated in that way. Antitrust, and anti-monopoly law more broadly (law that governs excess private power in any form), operated as an essential democratic tool. Courts and prosecutors and regulators routinely blocked mergers, even of what we might today think of as relatively small companies (with, say, five percent of market share), worrying that if you allow multiple smaller roll-ups, you’ll eventually face a power-seeking private player threatening democratic control.

Then in 1980, as one key component of the Reagan Revolution, this new administration began appointing (at the Federal Trade Commission, and the Department of Justice, and in a massive number of court vacancies) spokespeople for an ideological vision coming from the University of Chicago (often characterized as “the Chicago School”), with Robert Bork as one prominent reference point. Over time, these new federal appointees basically stripped the democratic rationales and functions out of our antitrust laws. Antitrust got drastically narrowed down to maximizing consumer welfare, itself narrowed down to just keeping prices low. Antitrust interventions only went forward when overwhelming evidence showed that a proposed merger or pattern of predatory behavior would inevitably and almost immediately lead to higher prices.

“Monopoly” itself dropped out of the popular vernacular, and became a technical term that supposedly only professional economists understood. Anti-monopoly sentiments, so central throughout much of 20th-century popular political conversation, started to disappear from public circulation. Within the few decades that have followed, the US economy has transformed from relatively decentralized to excessively concentrated. That of course drives today’s striking inequalities, and also undermines our democratic system in all kinds of ways.

Think of Gilead basically just telling us what remdesivir treatments for COVID-19 will cost — dictating the terms, and not even pretending to be subject to the forces of a free market. Drug monopolists can just pick and choose and charge whatever they want. So even if these companies defied all historical norms and shocked us with their low prices, the consumer-welfare standard will have allowed them to acquire too much power. We need to reclaim that anti-monopoly language and argument.

More broadly, Break ‘Em Up tracks existential-seeming threats faced by certain bedrock civic institutions: from public courts, to political parties, to investigative journalism, to “free” consumer and labor markets. For one unifying overall frame, what might a structuralist approach to today’s concentrated corporate power look like — perhaps not punishing bad monopolists’ behavior after the fact, so much as proactively establishing market conditions that prevent such dominance in the first place?

Structuralist approaches prevailed for decades, during modern America’s most decentralized period of economic and political life, from the 1940s through the 70s. The 70s actually had the highest level of equality — and also had, like you said, more of a preventative than a punitive antitrust approach.

Here campaign-finance law offers a good analogy. It contains both before-the-fact and after-the-fact possibilities. You can limit how much an individual or corporation can contribute, or you can catch somebody bribing and corrupting elected officials. Taking a prophylactic structural approach ends up being a hell of a lot more effective than trying to hunt down every single bad actor.

So in terms of taking a broader structural view on monopoly (particularly as a rival form of government, and as a pressing threat to democratic self-governance), could we start fleshing out new and distinct types of 21st-century authoritarianism by considering a few conspicuously dominant firms, such as Facebook, Amazon, Google? What makes, say, Facebook’s claims to enable and empower democratic decision-making on its network especially dubious? What kinds of crucial decisions do a handful of Facebook executives end up making for billions of us?

For one example, we had these recent protests around Facebook’s decisions on what to publish and prioritize when Donald Trump recirculated certain white-nationalist posts (among of course many other hateful and false posts from Trump). I find pretty problematic this basic structure of argument, in which protestors more or less beg Facebook to act — so treating Facebook as a legitimate governor of what kinds of speech our democratic society will allow. Instead I’d prefer to hear protestors saying: “Okay, we have a fundamental problem with what has become an essential communications infrastructure algorithmically prioritizing hateful, racist, and false speech. This cannot continue. Congress needs to break up Facebook’s monopoly grip on our infrastructure, and regulate this business model so that it serves the public good.”

And sure, we might not have much faith in our current Congress taking up these duties and acting responsibly. But we ultimately have the power to make Congressional representatives respond, or to vote them out of office. Mark Zuckerberg, on the other hand, has no need to represent the public interest in shaping this essential communications infrastructure. He faces no threat of us voting him out if we get angry enough. So I consider this an illegitimate form of governance. I don’t feel the need to request: “Hey Facebook, could you please stop promoting this or that hate speech?” I’d much rather we all said: “Hey Congress, everybody can see this out of control, mafia-like organization taking over our public infrastructure. We need some new laws, or we need some new Congressmembers.”

Alongside Facebook’s horizontal hold over certain lines of basic social infrastructure, how does Amazon’s business model epitomize vertical integration? In what ways has Amazon already become a coercive quasi-state for millions of suppliers (while pushing them, in turn, towards maximum exploitation of their own workers)? And how best to block Amazon from further consolidating its manifold marketplace, transportation, cloud-computing, and government-contracting endeavors — its pursuit of cornering not just any one particular industry or sector (though it does that too), but commerce more broadly?

First, just because something impacts your life doesn’t necessarily mean that it governs you. So we need to develop theories and models to clarify at what point a private entity starts displacing public power to regulate a substantial part of the economy, and in that way governs certain aspects of our lives. When does an economic player not just supply us with goods or services, but begin to dictate terms? With Amazon, answering that question means moving beyond our collective bamboozlement, and starting to see this firm not as a website, but as a concentrated corporate power reshaping (and seeking to take over) our national transportation infrastructure, our nation’s storage facilities and warehouses, our marketplaces of course. If you sell shoes or frisbees or certainly books, you can’t opt out of Amazon — just like, if you live in a big city, you can’t opt out of using the sidewalk. Theoretically, perhaps, you could stay away, but you’d end up completely stuck.

Because you now have to use Amazon in order to reach consumers, Amazon effectively can set the price of your product. If your shoes cost 50 dollars on Amazon and 60 on your own website, everybody will just buy them from Amazon. At that point, Amazon effectively manages the market, regulates price, and increasingly sets its own fees for accessing this basic commercial infrastructure of our contemporary lives. And while operating as a governing force in these ways, Amazon never faces the need for transparency, the pressure for accountability so crucial to good governance in the public sector.

Amazon, for example, can treat each seller in its market differently. If you and I both sell frisbees and compete against each other, where I land in Amazon’s rankings when somebody searches for frisbees might make or break my business. But the algorithm by which Amazon arrives at its rankings never faces any regulatory scrutiny — even as some evidence (and much suspicion among suppliers) suggests that Amazon might have developed various kickback and protection schemes, so that the more you pay Amazon, the higher you’ll rank in search results. In this kind of marketplace, it no longer matters which of us designed a frisbee that flies farther. Instead, we’ve basically returned to a feudal system, with you and I competing over who most pleases our lord Jeff Bezos. We remain forever subject to his whim. We, like many Amazon suppliers today, probably also need to hire outside consultants to help us navigate this whole Amazon system, because if we got kicked off it, that would be our death sentence.

Again, we shouldn’t kid ourselves and pretend that this kind of power just obediently stays in “the economic sphere.” Franklin Foer, for example, has written about Amazon’s terrifying control over book distribution. Amazon has shown itself perfectly willing to punish publishers who speak up and demand better contract terms. Amazon has no problem delaying sales of such a publisher’s books by two weeks. And while I haven’t seen evidence of Amazon making content-based determinations in its book algorithms, nothing stops it right now from doing that. I mean, when I first pitched this book, some agents would respond: “No chance of leaving out Amazon?” [Laughter]. If nothing else, that chilling effect alone diminishes genuine democratic debate.

Google’s state-like ambitions stand out here particularly through its knack for embedding itself within foundational civic institutions (from children’s basic education to elite academic research, for example), and within any number of essential everyday functions (search, email, geographical navigation). Could you describe the types of political leverage (alongside, of course, the vast surveillance-based ad revenues) which Google has gained through all that it provides us for “free” — and that we at least used to associate with the public sphere?

Great question. Google has emerged as this very sophisticated political actor. It took a long time for us to see Google as not so different from an ExxonMobil. To be honest, we probably underestimated, particularly during Democratic administrations, Google’s infiltration on key policy questions. We definitely made that mistake with certain Internet companies heavily funding think tanks. I mean, when I was a New America fellow, our research subset criticized Google and then got booted out within a few months. The New York Times reported that this foundation’s ties to former Google CEO Eric Schmidt played an instrumental role. And Google’s nonprofit think-tank funding is pretty ubiquitous.

You also mentioned how Google has embedded itself within foundational everyday institutions like our public school systems. Districts around the country don’t just dabble with Google services, but require teachers and students to use Google products. This essential-infrastructure role for Google should worry us, say when a Google subsidiary like YouTube gets fined for illegally targeting ads to kids (a fine so small, unfortunately, to not even merit mention in Google’s regular report to investors). At the same time, while Google claims not to profit off of these kids’ data, it certainly still collects an enormous amount of data. It can afford to give away these omnipresent programs “for free,” but it also gathers enormous amounts of information about future teenagers, adults, consumers, clients.

In New York City, where I live and work, we really need to watch out for Google as it moves directly into more and more public domains, basically doing with physical infrastructure what Facebook has done with certain forms of communications infrastructure. Facebook says: “If you want to use Facebook, we get to spy on you, gather an endless stream of information, and then pitch back advertising to you, and sustain ourselves that way.” Google then took that model and backed a consortium putting up thousands of kiosks across New York City, providing a critical public function. People now rely on these kiosks as places to plug in your phone, and access a Wi-Fi hotspot, and make a phone call, and learn some cute fun facts about the city. These kiosks have become quite useful resources. Google doesn’t “charge” users when providing this public function. Instead, it extracts profitable information about the public through data collection. Each kiosk has over 30 sensors on it gathering information not just about its users, but also about everybody else moving past — by pinging their phones.

Today, most of us grasp that gaining granular information about a polity and its citizens provides enormous power. But while Google’s arrangement with these kiosks prompted a few protesters, most residents considered it a good deal. And once you have kiosks, why not move onto buses? Maybe we can’t fund the buses adequately through our meager public-transit budget. But maybe if corporations will pay to post “Free Wi-Fi” signs, and to extract users’ information, cities and towns can fund essential public services. The less obvious costs come with letting firms like Google increasingly operate as private technocratic governments lacking any public accountability.

To pivot away now from particular firms, to sector-wide structures of dominance, private arbitration (often established through consent agreements that waive one’s rights to join class-action claims, or even just to reach a public jury) comes across as most problematic not for its notoriously opaque language, but again for the coercive power relationship which it reflects and appears to naturalize. How does this overt “race for law suppression” then further undermine public authorities, say by closing off possibilities for transparent litigation, for antitrust enforcement, even for basic civil-liberties and civil-rights protections?

Arbitration connects directly to monopoly, because although they theoretically can exist independent of each other, big corporations are the big actors in arbitration. Monopoly power makes arbitration unavoidable for many Americans, taking away any freedom of choice. If you need to have a cell phone, then you need to consent to arbitration — because the few cellular providers in this monopolized sector require the same basic arbitration contracts. Similarly, in the labor market, if you need a job, and if only a small handful of firms would likely hire you, then you’ll probably need to sign away even more.

Again, these remarkable and truly disturbing trends started gaining momentum several decades back. In the 1960s and 70s, a series of profoundly important federal civil-rights laws get passed. Two predictable corporate strategies emerge in response. One strategy seeks to overturn these laws. Big firms might decide, for instance, that instead of facing endless enforcement headaches over a new age-discrimination law, they’d rather press Congress to come to its senses and overturn this law in democratic fashion. Alternately, they might try something far more ingenious. And they do in fact end up creating this new forum that looks like a court to enforce those rights established in the 1960s and 70s, but that in fact becomes a place where rights go to die.

In theory, I might have the right not to be discriminated against based on my age or race. But in practice, with private arbitration, the only forum where I could make a claim happens to have a judge paid for by my employer, a judge who doesn’t need to follow any transparent process for how evidence gets obtained or used, who maybe faces strict caps on what kinds of damages I could be awarded — in a proceeding I might not have any legal right to witness in its entirety or to discuss publicly.

Given these constraints, individuals didn’t just have a harder time winning cases against corporations. Cases vanished altogether. The incentive to hire a lawyer disappeared with the chance for a positive verdict so low. And lawyers denied the possibility for a class-action suit had less incentive to join the fray. Instead of overturning landmark laws, corporations figured out how to overturn our democracy’s whole legal process, and work around those laws.

Private arbitration likewise points to how concentrated power often exacerbates pre-existing disparities, say along racial lines — with those possessing the most secure social position best equipped to opt out of such unfavorable arrangements, and with those facing economic precarity feeling compelled to opt in.

Absolutely. You still have this absurd modicum of choice. I mean, if I’m a 25-year-old with $40 in savings, in theory I could tell this employer who just offered me a minimum-wage job: “I’d like the job, but without your arbitration clause.” Theoretically I could negotiate this way, but of course that’s a joke. In Break ‘Em Up I discuss the illuminating example of Harvard law students who all banded together to resist taking summer positions at law firms demanding arbitration clauses. Well, you don’t get more empowered than Harvard law students deciding on a summer-associate job. And they still had to fight for it. Whereas if you say no to IHOP, well, the McDonald’s next door has the same arbitration clause.

Could you also sketch a couple more insidious overlaps between white supremacy and market concentration — say in terms of undermining small businesses that provide communities of color a crucial pillar of strength, or in terms of perennial efforts by American corporations to bundle a rhetoric of racialized dog-whistling with a broader anti-regulatory agenda?

Yeah I’d start from the great W.E. B. Du Bois, and his work as an ardent anti-monopolist and chronicler of this relationship not just between land monopolies and slavery — but between, say, credit monopolies and a post-Reconstruction suppression of black political and economic power.

Break ‘Em Up points to various ways in which race and monopoly power interact. Most obviously, when our economy gets as concentrated as it is now, that likely means almost all white CEOs and white financiers. A much higher percentage of black and brown business owners operate small and medium-sized businesses, rather than Fortune 500 firms. So the more an economic sector gets merged, the more this diversity gets bleached out. Since the Civil Rights era, for example, the black economic power (which can translate into black political power) that had existed with independent black pharmacists, with independent black transportation companies, with independent black funeral-home directors, has too often found itself under threat as one industry after another gets concentrated and monopolized.

Break ‘Em Up also tracks this bargain made between big companies like AT&T or Pfizer and white politicians willing to inflame and exploit racial hatred in pursuit of political power. We’ve seen this play out in North Carolina, for example. When you look under the hood, you find that the funding and momentum and even the actual language for harsh voter-suppression laws came from an alliance between ambitious white politicians and the American Legislative Exchange Council (and all of the supposedly neutral, benign, household-name firms quietly funding ALEC).

Then with more localized tactics now in mind, could we also start looking at chickenization, particularly as it has come to dominate countless rural communities seemingly comprised of independent family farmers and small-business owners? How does this most literal mode of chickenization exemplify some of today’s most ruthless predatorial tactics: with colluding firms exploiting their dominance to establish opaque pricing schemes, to impose barely endurable conditions on suppliers, to enforce a broader social silencing about such conditions (again through private-arbitration agreements), to treat unwitting farmers as subjects for capricious corporate experimentation, and to quickly appropriate any individual’s successful innovations along the way — for company profits and further consolidations of power?

This chickenization idea came in response to Chris Leonard’s wonderful reporting in The Meat Racket. Within the chicken industry itself, a tiny handful of distributors (Tyson, Perdue, Koch Foods, Sanderson Farms, and Pilgrim’s Pride) have taken advantage of the Reagan revolution’s antitrust approach to basically gobble up competitors and also to vertically integrate the industry. Today these five firms control almost all aspects of chicken production, but don’t technically own the individual farms. As a chicken farmer, you almost inevitably need to go through whichever of these giants dominates your region. You have very few options for getting your chicken to market.

So in effect, Tyson can tell you exactly which feed to use, exactly what lighting to have (you keep these facilities dark, to limit cramped chickens pecking each other), exactly how much water to provide. They can dictate the precise dimensions and every specification of your (potentially multi-million dollar, almost inevitably debt-producing) chicken house. If you decline to follow any of these demands, Tyson can just say: “We don’t want your chicken.” Theoretically, as an independent chicken farmer, you still could make that choice and accept the consequences. But you don’t have any real decision-making power about how humanely to raise your chickens, or what kind of environment to build for them, or which advisers to consult or which techniques to adopt. And of course these firms require not only a standard arbitration agreement, but a clause explicitly preventing you from disclosing to neighbors and fellow farmers and local suppliers how much you get paid for your chickens.

Total silence gets actively enforced between one chicken farmer and another. That also means total invisibility for Perdue’s relations with its suppliers. So Perdue can perform all kinds of undisclosed experiments on farmers. It can send a new feed to 20 farmers, and the older kind to 400 farmers, and see what difference this makes. From its centralized position, Purdue can innovate through trial and error, extract data, pay various suppliers differently, figure out the financial breaking point for each individual farm — without offering any transparency on any of this. The human effects of this cramped and opaque arrangement (similar to that for Amazon’s sellers) can’t help but breed fear and paranoia and suspicion and gossip, forces that corrode an open society’s public discussions and decision-making.

Did I have an unlucky month, or make a mistake in managing my animals, or did Pilgrim’s Pride want to punish me? Did I say something wrong to somebody? Those quite natural and rational questions can’t help but come up when you get kept in the dark about your whole work environment, totally subject to the whims and self-interested experiments of some central distributor. So politicians might praise our independent family farms, but fail to provide these farmers with anything like a free and fair and open market. Instead we have top-down control, with one central source surveying and collecting information, then using that to further increase its profits and power and force of intimidation. On the other side, we have individual farmers who can’t challenge that power center, and can’t band together to increase their collective strength. As soon as they speak out, they can expect to face concentrated, legally enforceable retribution.

Your book describes well how this multi-pronged domination of many rural Americans’ economic lives also extends beyond the buying and selling of chickens: say to the seed, grain, and agricultural-equipment industries. And of course chickenization also plays out in primarily urban sectors of our economy — such as with ride-hailing services premised on an offloading of corporate liability, and on an algorithmically maximized gouging of both workers and consumers. So given how predatorial experiments imposed on drivers, or how the siphoning off of any profitability won through individual ingenuity, again shape the very business model of data-powered firms like Uber and Lyft, why, in such workplace contexts, do we need more than expanded data ownership? Why do we need to break up the basic asymmetrical dynamic in which only one side (and only two firms) has access to these massively aggregated data streams?

One common response to today’s data-surveillance crisis focuses on the idea that everybody should own their personal data, and should have some say and get some compensation when this data gets sold — amid the immense profits that big companies already make off of it. But I consider that a wrongheaded view, because if you maintain this basic structure of centralized power, concentrated corporate dominance inevitably creeps in. Again, in post-1980s labor and commercial law, corporations can contract around anything as long as all participants remain “free” to opt out. And then, if you didn’t have a literal gun to your head when you signed the contract, you have to live by its terms. So the chicken farmer theoretically might possess a paper right to control his or her data. But then Tyson might say: “Okay, I’ll pay you one cent for that.” And then the chicken farmer basically has to say: “Okay. Here you go.”

Granting individuals data ownership doesn’t actually allow the chicken farmer or the Lyft driver to live with autonomy and dignity, free of surveillance, enhancing her personal earning power through her own innovations. Instead we need structural responses. That might at times mean breaking up dominant firms, or ensuring they face real competition — or if we truly need one single monopolizing firm for some reason, then heavily regulating or even nationalizing it. In any case, once you have today’s kinds of power asymmetries (either in data or other workplace conditions), workers basically need to line up and hope at best for feudal relationships.

So most generally, why would you recommend us staying suspicious of a rhetoric emphasizing the “tech” (seemingly new), “platform” (seemingly neutral), or “disruptive” (seemingly decentralized) components of this gig economy? And above all, why should we think of gig-economy labor markets not as “removing the middleman,” so much as replacing a large set of competing (potentially triangulated) intermediaries with one single (dangerously dominant) intermediary?

Dystopians and utopians often converge on fallacies of this technologically determined gig economy that has succeeded in removing the middleman. In fact, our gig economy has come about as a result of law, contract, and political choice — and has created even more powerful middlemen. Giggism results from a society choosing to leave certain workers in a precarious state, instead of providing them long-term options within a firm (with owners of capital and with corporations facing an obligation to provide job security and good benefits to workers).

Our technology rhetoric often obscures basic facts about labor relations. Activist groups in California and elsewhere (like Gig Workers Rising) have done essential work to start exploding these myths, but technological determinism remains a powerful fantasy that gets in the way of action — suggesting we could only at best ameliorate conditions, instead of changing structures of power. I have even less patience for the “disintermediation” fantasy. Who has more power today than TaskRabbit, or Uber, or Google, or Amazon? These middlemen control far too much. Luckily, I think this whole platform/decentralization/no-middleman story already has started fading.

Here again, external forces no doubt have contributed to diminished labor power. But where do you see American labor itself having overemphasized in recent decades shorter-term policy gains (wage increases and related concessions), while seeming to take for granted ongoing and even escalating disparities in longer-term power relations? And what best explanations could you offer for why union leaders haven’t yet taken on resisting market concentration as perhaps their most fundamental fight?

Yeah, that has been a really important part of the puzzle for me. It still feels like a big, big question mark. Why hasn’t American labor fought harder against corporate monopolization? And of course they sometimes have. In a handful of instances over the past few years, labor unions have stood up against a merger. But even then this happens basically as a bargaining chip, rather than as part of a long-term strategic vision. It allows unions to achieve some concessions, but also reinforces a dynamic in which unions don’t do much beyond asking for concessions. Within America’s labor movement, you just don’t see much genuine fear of excessively concentrated power, really as an existential risk that monopolies pose to labor.

But when I say existential, I mean existential. I mean that when Spectrum dominates the New York City market, they won’t even come to the table anymore to bargain with workers. They don’t have to. With one potential employer in town, where else could these technicians go?

And more broadly, a lot of different possible reasons might help explain labor’s indifference or reluctance to take on monopoly power. For a long time, for example, labor leaders have seen it as more efficient to organize in a large workplace. Up to a point at least, it might cost the same to organize 200 workers as 500. So why not focus on larger workplaces? But at a certain point, economies of scale shift to the benefit of corporations. The concentrated power dynamic just becomes overwhelming, and nothing like a free or open labor market can sustain itself.

Recent depressing research shows that monopolization now costs American workers as much as 300 dollars a month on average — and in more concentrated regions and economies, people have even less bargaining power. So you’d think that labor should prioritize monopolization at least as much as corporate CEOs have. But I say all of that with real sympathy for labor leaders dealing with enormous pressures from so many different sides. This book, for example, doesn’t focus on trade, though our trade policy over the past several decades definitely has weakened labor’s hand.

Along with automation.

Right. So I wouldn’t want to turn to labor groups, already carrying so many different burdens, and say: “Why don’t you pick up this burden too?” Though we do need labor to take on corporate monopolies in its own way, because it does have a unique position and a distinct role to play in stopping mergers, protecting worker dignity and bargaining power, and fending off a concentrated marketplace. Overall, I hope for this book to offer a sympathetic but pretty clear call for more labor anti-monopolism.

Do you want to flesh out a bit this acute power labor unions have particularly during a potential merger situation?

Sure. We actually see something similar with the recent Amazon fight in New York. The Retail, Wholesale and Department Store Union played a critical role in stopping Amazon from building its second headquarters here. That wasn’t a merger moment per se, but labor did recognize its distinct capacity to block a behemoth from further consolidating power. Amazon wouldn’t agree to basic union perks. And labor showed at that critical moment how its interventions can be absolutely transformational. So sometimes people think of anti-monopolism and labor-unionism as two alternative approaches to our modern economic crises, but instead we must see them as compatible and even mutually sustaining. You probably can’t be pro-labor today unless you’re anti-monopoly — and vice versa. Maybe most of all, I just want readers of this book to imagine those two forces coming together.

Well your book even includes a further-reaching (mid-21st-century) glimpse at what a moral political economy could look like. How might such a vision embrace certain market commitments of a Montesquieu, of an Adam Smith or a Friedrich Hayek, while still catalyzing ethically minded thought and action across even its most commercial realms? How might it preserve nonmarket spaces while still presuming that markets have their own role to play in promoting human freedom, creativity, warmth, compassion? How and why should right- as well as left-leaning political perspectives see their own most foundational values affirmed here?

So we shouldn’t just say: “I dislike this certain part of our concentrated economy, but I can’t imagine how to change the whole thing, so I’ll just have to throw my hands into the air and hope for cheap prices and fair employers.” That sense of powerlessness is just a plain mistake. We can introduce or reinvigorate co-op models. We can unionize more workplaces. But to get there, we have to break up the central barriers to a moral economy.

For me, a moral economy would mean that one can compete on the merits and make money and build a successful business — without single-mindedly pursuing profits and power like some self-aggrandizing psychopath. Again, to get there, we need some baseline rules for the treatment of workers, for breaking up some overly centralized firms, and ideally for preventing Goliaths from ever forming and bringing out these more problematic sides of human nature. We also need to move toward forms of corporate law that allow business leaders to decide to prioritize treating their workers better, instead of pushing for a more exploitative bottom line. We can do all of that within a thriving market economy.

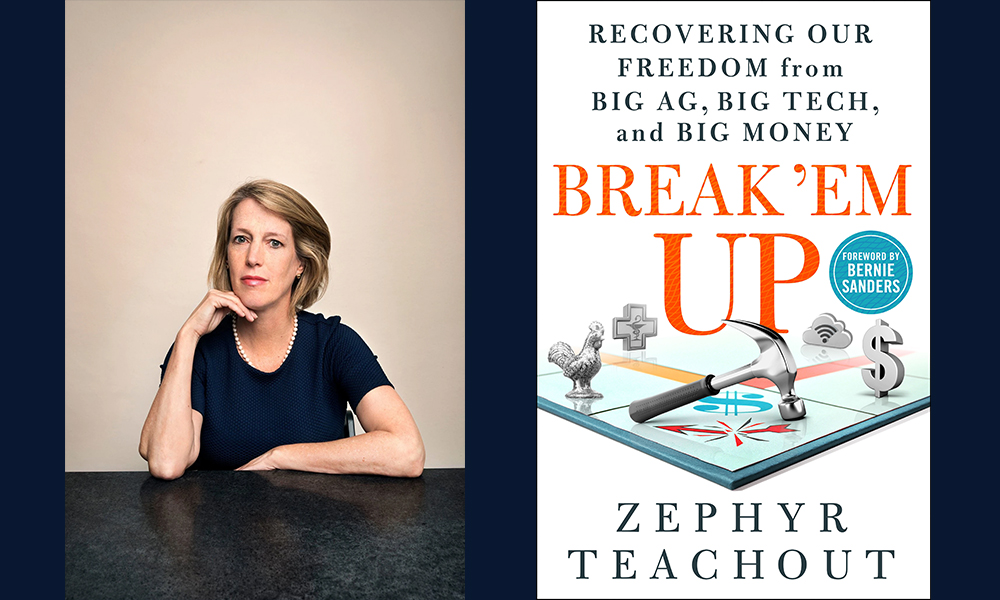

Portrait of Zephyr Teachout by Jesse Dittmar.